SAREGAMA VALUATION

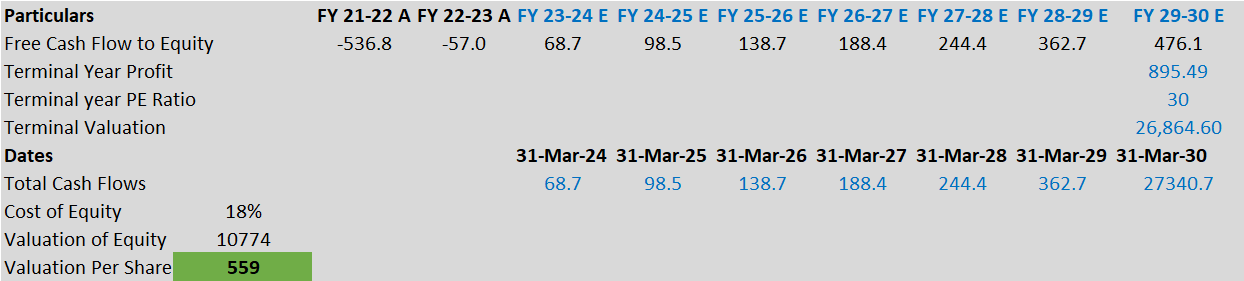

BASE CASE SCENARIO

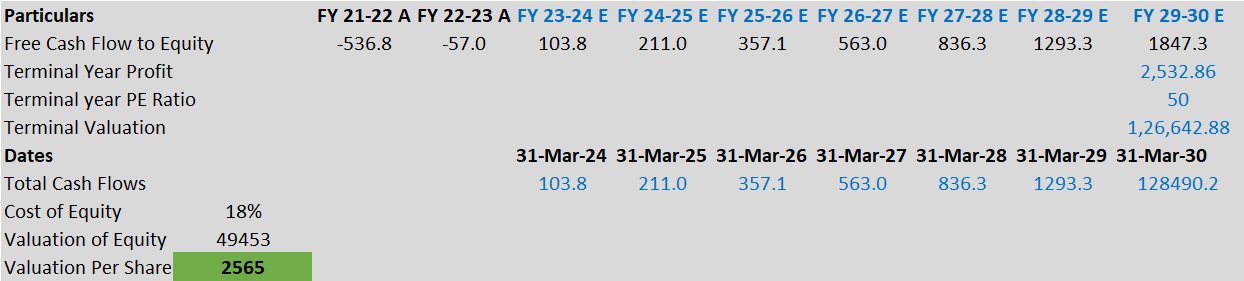

BEST CASE SCENARIO

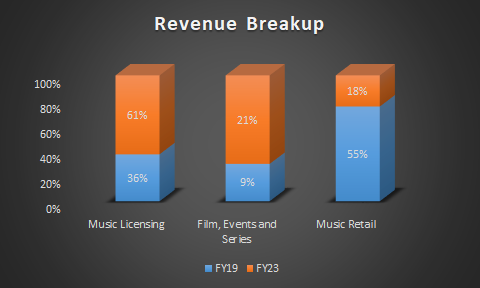

Saregama, a part of the RP-Sanjiv Goenka Group, a large conglomerate, is one of the oldest music label companies from India, among the likes of T-Series, Tips, Balaji Telefilms, etc with large intellectual property portfolio of 150K+ songs, 70+ films and web series, 6K+ hours of television content Saregama has pivoted at the right time from a music retailer to a pure-play content company.

Saregama has three main divisions: Music (Licensing and Retail), Films, Web series & TV Serials, and Events.

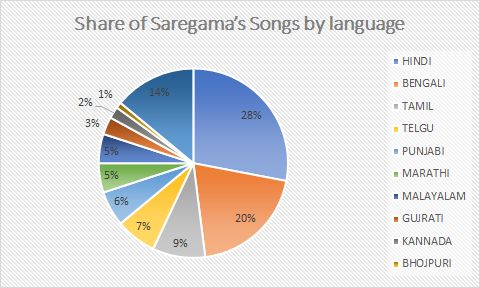

Music Segment- Saregama has India’s largest and most popular music catalogue with over 150,000 songs in 18 different languages, including film and non-film music, spanning multiple genres.

Music (Licensing and Retail)

HOW DOES SAREGAMA MAKE MONEY THROUGH ITS MUSIC IP

1. Music licensing –

The company holds Rights to Master IP (actual song) and Publishing IP (lyrics, composition) across all media for global territory, across its library. This music is non-exclusively licensed to partners for short periods, on a variable or fixed fee basis. The company licenses its songs to Music Streaming, Video Streaming, and Short-format Video platforms through various types of commercial structures.

Saregama earns every time a customer listens to a Saregama song either as revenue per play or a partial cut from advertisement (ad) revenue from these platforms:

Revenue per stream: For free users, the company on average earns around 10 paise per stream for its song across various OTT audio platforms. In case of video OTT platforms such as YouTube, the company gets a share of its ad revenue.

Share in subscription fee: When it comes to paid users under the subscription model, the platform shares a percentage of the subscription fee with record labels. This is the most exciting aspect of the company for us. Currently, three out of the top six OTT music platforms (Gaana, Resso, and Hungama) have moved behind paywalls.

According to the management, While audio streaming subscriptions are still at a nascent stage in India, wherein a little over 1% of users pay for music, there is immense potential if the subscription plans are right, By elevating the user base’s music subscription fee by a modest 6%, the potential exists for the company to achieve a revenue growth ranging from 2.5 to 5 times its current level.

The music licensing is recognized as a high-margin and value-adding business segment. All these OTTA platforms are in the early stages of growth with huge upside potential over the next few years, on the back of content consumption growing online. Both advertising and subscriptions are expected to drive this revenue growth.

NO LONGER A CATALOGUE COMPANY

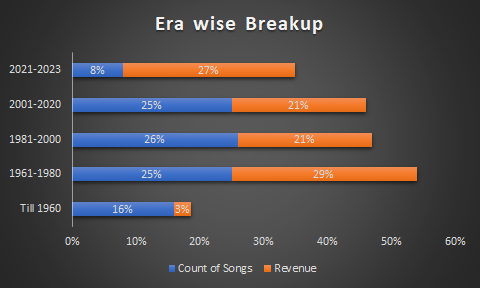

Out of 150000 songs, 33% of Saregama’s songs were released post-2000, contributing to 48% of FY23 revenue compared to 30% in FY21.

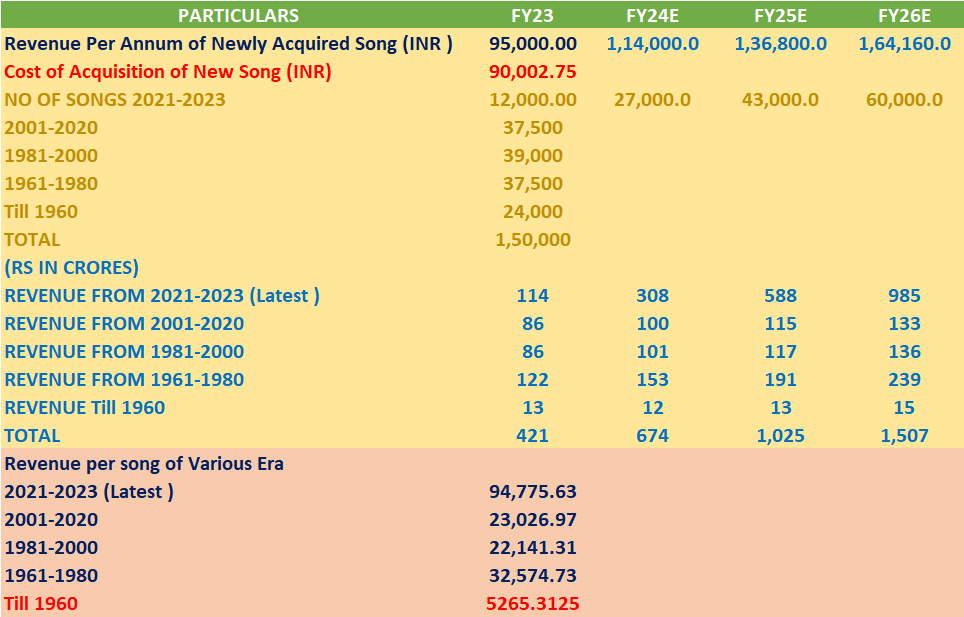

UNIT ECONOMICS OF LICENSE REVENUE

Currently, Saregama earns approximately INR 114 crores in revenue from a recently acquired song and 421 crores overall from Lincense fee, primarily through the Revenue per Stream model. The company aims to acquire 25% to 30% of all newly released music in India, intending to invest around INR 1,000 crores over the next 3 to 3.5 years. With a YOY growth in License Fee per song averaging 20% for the latest released songs, can lead revenue from the latest song to grow multifold.

2. Music retailing through Carvaan –

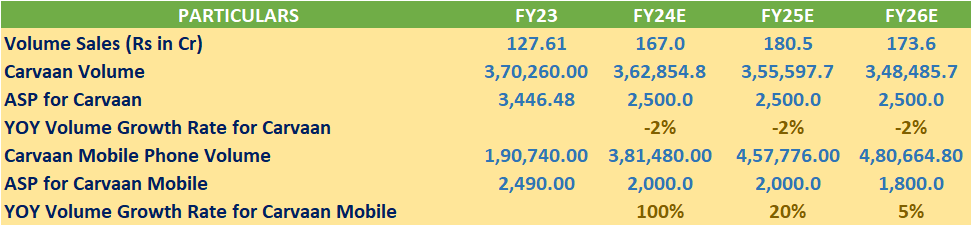

Saregama reinvented itself in 2017, with the launch of Carvaan as an audio player with inbuilt speakers and 5,000 preloaded songs. The company has since launched various models of Carvaan including base model, Mini, Mobile and Music bar with similar margins across all variants.

Saregama now positions the product as a platform with daily updatable audio content in the form of songs, prayers, content for kids, 3rd party hosted content and audio podcasts. Thus, the company aims to transform Carvaan from a one-time margin product to a recurring advertising and subscription revenue product.

ALTHOUGH CARVAAN TURNED OUT TO BE A GAME CHANGER FOR THE COMPANY BUT WE BELIEVE GOING FOWRWARD LONGEVITY OF CARVAAN AS A BUSINESS SEGMENT MAYBE IN QUESTION – This is due to its primarily targeted demographic of older individuals seeking a nostalgic experience. With the increasing availability of cost-effective data and easy access to an extensive song library on various streaming applications, elderly consumers now have the option to access their favorite music without the need for a dedicated device like Carvaan, which is often presented as a gift.

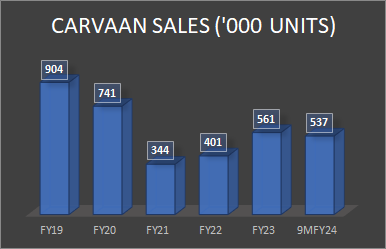

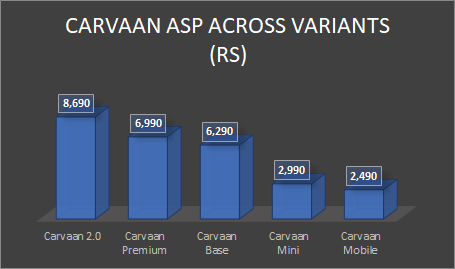

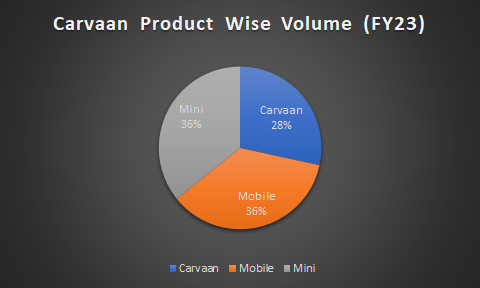

The company has not been incurring any additional costs for marketing of Carvaan and has been selling it completely as a pull product. While the unit sales of Carvaan increased by 40% YoY to 5.6 lakh units in FY23 and up to 5.4 lakh in 9MFY24, the overall sales have come down in recent quarters due to increasing share of lower Average Selling Price (ASP) products like Carvaan Mini and Mobile.

UNIT ECONOMICS OF MUSIC RETAIL

Films, Web Series, and TV Serials Segment

Unit economics of Films, Web Series and TV Serials Segment –

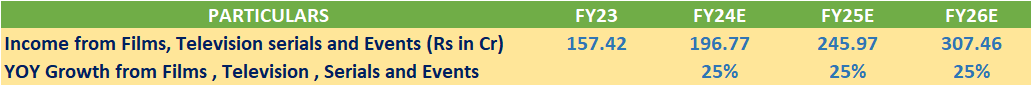

- Management has guided a 25% growth in revenue and a 15% margin.

- Film segment is considered to be a lumpy business- To overcome this lumpiness the company has adopted a revenue-first strategy for films and web series production, where it first secures a licensing deal with the digital platform and only then starts to make the production

- Total capital allocation for Films, Web Series, and TV Serials Segment will be maintained within the upper limit of 18%.

Films and Web Series – In 2017, Saregama forayed into films and web series content creation for 3rd party digital platforms under the banner “Yoodlee Films”. Over the last 4 years, Yoodlee has successfully licensed/released 25 films on various digital streaming platforms. Yoodlee targets to launch over 60 films and web series episodes over the next 3-4 years. However, the management is clear that it will be producing theatrical films only for regional languages and web series across all languages for OTT and does not aim to foray into the production of big-budget Bollywood movies.

TV Serials – Saregama plans to continue its TV serial production for Sun TV, generating 1200-1500 hours of annual content. As of FY23, the company has created 6,000+ hours of TV content and at any given time broadcasts 3-4 serials creating around 15-16 hours of content per week

The IP of these serials is owned by Saregama and is also monetized on other platforms like YouTube (1.8 Bn views in FY23).

Events Segment- Saregama is strengthening its relationships with the artists by organizing entertaining live performances. Ticketing is the primary revenue source, supplemented by sponsorships and the use of video assets of the performances on digital mediums. Deeper relationships and brand value will further help the music licensing vertical of its business.

New Initiatives – Artist Management and Music Learning App

Artist Management – Saregama’s new vertical under music licensing is Artist Management, where the company signs up with artists and make them popular by placing them in its IP releases. Once the artist is made popular, Saregama then monetizes these artists by getting brands for them who want to use them for the reach these guys have created on Instagram or YouTube and also place them in various live events. And whatever money the artist makes, Saregama gets a share of it. Saregama currently has 123-odd artists, under Pocket Aces and 15, under Saregama.

Music Learning App – The company plans to launch a music learning app through which it will teach music fans how to sing or play using AI through paid courses. The company believes that this is one more way for it to monetize its library. The company expects to launch the app sometime in April or March 2024.

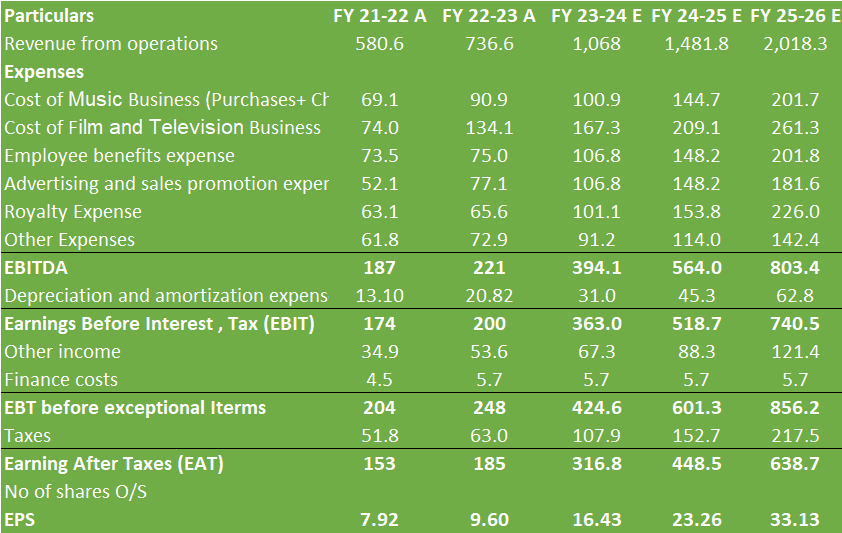

FINANCIAL SUMMARY

INVESTMENT RATIONALE

Saregama has uniquely positioned itself as a ‘Pure play content company’ with primary focus on creating or acquiring content and monetizing it to third parties on an exclusive or non-exclusive basis. The industry’s shift towards the highly underpenetrated subscription model from ad-based model, especially in the OTT-Audio (OTTA) segment, is what we believe will provide additional levers for improved realization of Saregama’s content.

The digitization-led demand for content in India has been rapidly increasing as consumption patterns transition from mass entertainment to customized content with multiple offerings across multiple platforms. India’s OTT Audience universe has grown from 35.3 cr in 2021 to 48.1 cr in 2023. With the OTT penetration in India estimated at 34% in 2023. Saregama aims to capitalize on this content consumption boom, both through licensing its existing IP and building up new IP.

KEY TRIGGERS

- The 3rd party licensing revenue for Saregama is expected to be driven by: (a) Increase in number of users led by increased internet penetration and low data costs and (b) Increase in revenue per stream as resulting from user migration towards the subscription model from ad-based model

- India remains one of the least penetrated countries in terms of paid audio streaming subscribers with around 1% of the total audio OTT subscribers being paid subscribers in 2021. The Indian Music Industry (IMI) expects the ratio of paid subscribers to overall OTT subscribers to increase from 1% in 2021 to 8% in 2025 and 14% in 2030.

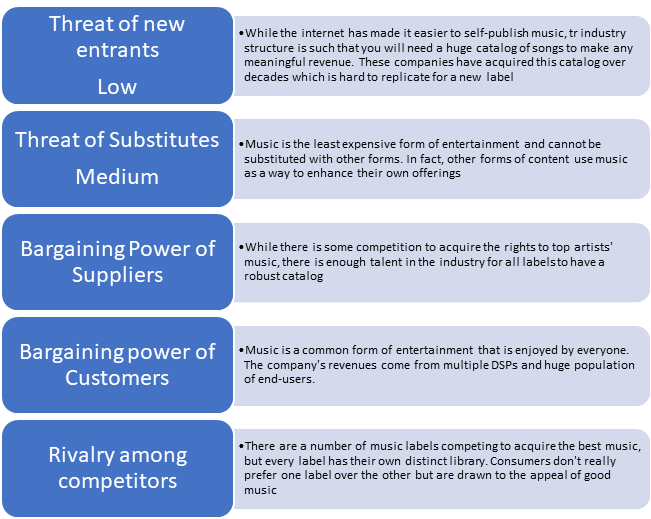

PORTERS FIVE FACTOR MODEL