Nifty 13% Decline: A Reality Check Beyond Earnings

The recent 13% decline in the Nifty 50 index has been driven by stretched valuations, subdued Q3 earnings, concerns over Trump-era tariffs, and persistent FII outflows. With no new triggers to push stock prices higher, the market is undergoing a time correction, exacerbated by FII selling—This has led to panic selling often leaving retail investors […]

Danish Power: A Growth Stock in India’s Renewable Energy Boom

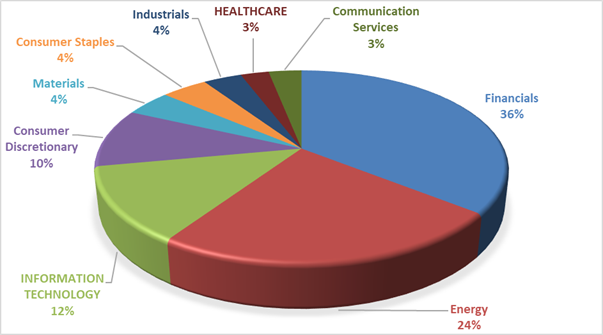

The power sector is poised for significant growth. Despite investing Rs. 111 lakh crore (US$ 1.4 trillion) in capital expenditures, with energy projects constituting approximately 24% of the total expenditure, an additional Rs. 33 lakh crore (US$ 400 billion) will be needed. Furthermore, by 2032, the sector will require 3.78 million skilled professionals to meet […]

ENVIRO INFRA ENGINEERS

Enviro Infra comes from one of the mega trend themes currently being explored – water and water treatment. Here is why: India ranks among the most water-stressed countries globally, with approximately 600 million people experiencing high water stress. Per capita water availability is around 1486 cubic meters (m3), against globally recognised threshold water stress of […]

Sportking India: A Value Buy

Sportking India Limited (Sportking), a leading yarn manufacturer, has delivered robust financial performance, efficient operations, and consistent growth. The company trades at a significant discount to peers with a P/E ratio of 12.3x compared to Ind PE of 18.75 and EV/EBITDA of 6x. Its expanding margins, debt reduction efforts, and strategic initiatives such as moving up the value chain […]

Should You Invest In Chennai Petro Corporation Limited?

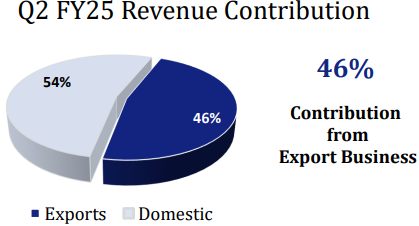

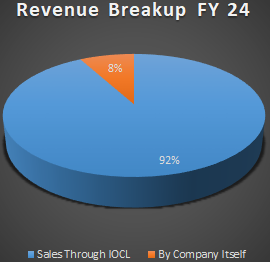

Chennai Petroleum Corporation Limited (Chennai Petro), a subsidiary of Indian Oil Corporation, is a key player in India’s downstream oil and gas sector, primarily engaged in refining crude oil and manufacturing petroleum products. Given the evolving energy landscape, increasing domestic demand, and CPCL’s focus on sustainability, the company’s Price-to-Earnings (PE) ratio stands at 12.5 times, […]

China Market Rebound: Opportunity or Risk for Investors?

Over the past week, the Hang Seng Index and the CSI 300 Index of china have experienced a dramatic reversal, transforming significant one-year declines into robust gains within days. Market sentiment has shifted decisively from a stance of “Anything But China” to “All In, Buy China.” Hang Seng Index Overview As of October 7, 2024, […]

Credit Rating Industry in India A Sunset Sector?

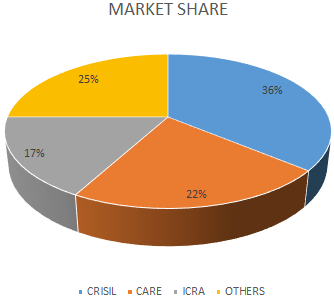

Credit rating business has fantastic economics. They enjoy superior operating margins in ~30% consistent, solid return ratios i.e Return on equity of about 30%. The business requires no debt. The only expense on their books is qualified personnel. FINANCIAL STATEMENT ANALYSIS (Rs in Cr) CRISIL Dec-19 Dec-20 Dec-21 Dec-22 Dec-23 TTM Sales 1,732 1,982 2,301 […]

WHAT ARE INVITS AND SHOULD YOU INVEST IN THEM

Had you invested in the IPO of INVITS, How much return would you have earned? INVIT FUND IPO Date Issue Price Cumulative Distribution Price as of (31-03-2024) Annualized return IRB INVIT FUND May-17 100 66.4 68 4.30% INDIGRID May-17 100 87.4 133 15% POWER GRID INVIT TRUST May-21 100 34.5 93 9% WHAT ARE […]

India’s Top Monopoly and Near-Monopoly Businesses

You may have heard enough about buying monopoly businesses or businesses with a strong economic moat which can not be replaced. The article below presents examples of some such monopoly businesses in India. Company Name Market Share Description Coal India 82% market share in coal production Indian Energy Exchange Ltd Controlling over 98% of electricity […]

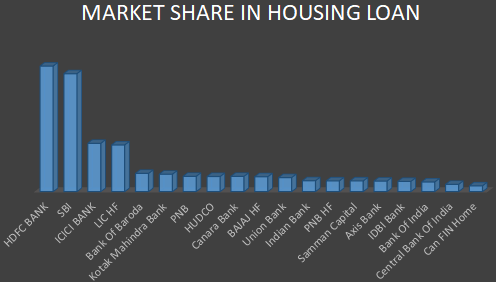

Which Housing Finance Company To Invest In?

Share of Housing Finance market – Here’s a list of players by the quantum of home loans. Housing Finance companies LOAN OUTSTANDING/AUM As of Mar-24 Rs in Cr PE Market Cap Market Share HDFC BANK ₹ 7,72,786.00 18.96 ₹ 12,92,266.29 22.208% SBI ₹ 7,25,818.00 9.71 ₹ 7,07,141.61 20.858% ICICI BANK ₹ 2,96,940.75 19.51 ₹ 9,08,025.54 […]