Blog

Blog

MBL Infrastructure Stock Analysis

Caveat: Major concerns around pledged shares and continuous fall of stock price. MBL Infrastructure Limited (“MBL Infra” or the “Company”) provides integrated Engineering, Procurement and Construction (EPC) services for civil construction and infrastructure sector...

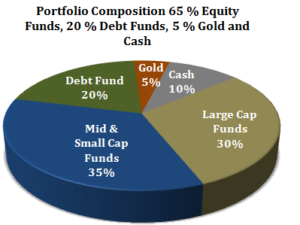

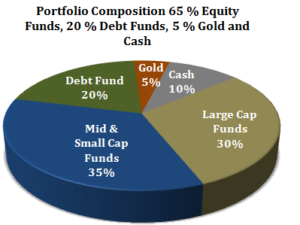

Best Mutual Fund Allocation

Single most important strategic decision in investing is how best you allocate your mutual funds investments. There are different types of mutual funds available to invest in including equity, index, debt, liquid, gold and thematic funds (like infrastructure, Pharma...

Indian Terrain Fashions Stock Analysis

Indian Terrain Fashions Limited (“Indian Terrain” or the “Company”) offer products in the premium casual wear range for men including jackets and winter wear products. The Company has 2 primary segments in apparel line; (i) woven, which include shirts, trousers,...

Best Valuation in IT Stocks at Current Prices

The recent correction in stock markets has brought down valuation for many sectors. Amongst others, Valuation in IT Stocks has come down significantly post the demonetization move by the Government. Keep in mind that IT stocks were already operating in a difficult...

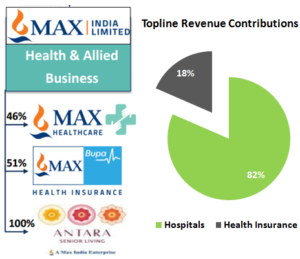

Max India Stock Analysis

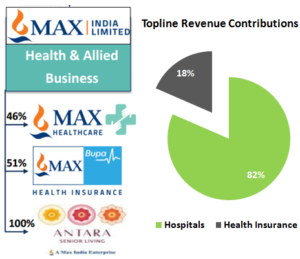

Max India Limited (“Max India” or “Company“) is engaged in healthcare business. The Company operates in 3 businesses: ► Healthcare: Max Healthcare, a subsidiary of Max India, in partnership with Life Healthcare of South Africa. ► Health Insurance: Max Bupa Health...

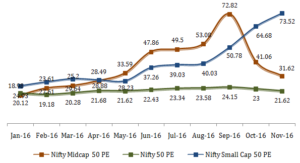

Large Cap Vs Small Cap Stocks – Valuation Differential

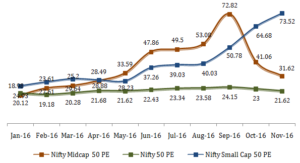

All prices and growth figures based on close of trading day on 18th November 2016. Over the past few years, mid and small cap stocks have run far ahead of their large cap peers in terms of valuations. Many mid and small cap stocks have given multi-bagger returns while...

Can Fin Homes Stock Analysis

While the public sector banks are suffering due to the concerns around high non-performing assets (NPAs), private banks and selected non-banking financial companies (NBFCs) have become the recent favorites among the investors. In the NBFCs space, we are bullish on Can...

Opportunities From Demonetization in the Long Term

Before I get to the impact and opportunities from demonetization over short, medium or long term, I would like to put out 3 disclaimers: Disclaimer on demonetization: The last time we had such an event was in 1978. That was a time when there was no ATM, internet or...

India Glycols Stock Analysis

India Glycols Limited (“India Glycols” or the “Company”) is a leading company that manufactures specialty chemicals, natural gums, spirits, industrial gases, sugar and nutraceuticals. What’s Positive for the Stock? Well Diversified Business The Company operates in...

At What NIFTY level will you start investing?

Over the past few months I have received many requests for portfolio rebalancing. Since August, I have been of the view that this is not the best time to deploy fresh capital in the market. Those already invested should try to rebalance their portfolios...

MBL Infrastructure Stock Analysis

Caveat: Major concerns around pledged shares and continuous fall of stock price. MBL Infrastructure Limited (“MBL Infra” or the “Company”) provides integrated Engineering, Procurement and Construction (EPC) services for civil construction and infrastructure sector...

Best Mutual Fund Allocation

Single most important strategic decision in investing is how best you allocate your mutual funds investments. There are different types of mutual funds available to invest in including equity, index, debt, liquid, gold and thematic funds (like infrastructure, Pharma...

Indian Terrain Fashions Stock Analysis

Indian Terrain Fashions Limited (“Indian Terrain” or the “Company”) offer products in the premium casual wear range for men including jackets and winter wear products. The Company has 2 primary segments in apparel line; (i) woven, which include shirts, trousers,...

Best Valuation in IT Stocks at Current Prices

The recent correction in stock markets has brought down valuation for many sectors. Amongst others, Valuation in IT Stocks has come down significantly post the demonetization move by the Government. Keep in mind that IT stocks were already operating in a difficult...

Max India Stock Analysis

Max India Limited (“Max India” or “Company“) is engaged in healthcare business. The Company operates in 3 businesses: ► Healthcare: Max Healthcare, a subsidiary of Max India, in partnership with Life Healthcare of South Africa. ► Health Insurance: Max Bupa Health...

Large Cap Vs Small Cap Stocks – Valuation Differential

All prices and growth figures based on close of trading day on 18th November 2016. Over the past few years, mid and small cap stocks have run far ahead of their large cap peers in terms of valuations. Many mid and small cap stocks have given multi-bagger returns while...

Can Fin Homes Stock Analysis

While the public sector banks are suffering due to the concerns around high non-performing assets (NPAs), private banks and selected non-banking financial companies (NBFCs) have become the recent favorites among the investors. In the NBFCs space, we are bullish on Can...

Opportunities From Demonetization in the Long Term

Before I get to the impact and opportunities from demonetization over short, medium or long term, I would like to put out 3 disclaimers: Disclaimer on demonetization: The last time we had such an event was in 1978. That was a time when there was no ATM, internet or...

India Glycols Stock Analysis

India Glycols Limited (“India Glycols” or the “Company”) is a leading company that manufactures specialty chemicals, natural gums, spirits, industrial gases, sugar and nutraceuticals. What’s Positive for the Stock? Well Diversified Business The Company operates in...

At What NIFTY level will you start investing?

Over the past few months I have received many requests for portfolio rebalancing. Since August, I have been of the view that this is not the best time to deploy fresh capital in the market. Those already invested should try to rebalance their portfolios...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter