Blog

Blog

Top Monthly Income Plans in India

Monthly Income Plans (MIPs) are debt oriented mutual funds, which invest a small part of the fund (15-25 %) in equities. MIPs offers regular income in the form of periodic (monthly, quarterly, half-yearly) dividend payouts. Investors can invest in MIPs with two...

Demonetization: Impact on stock markets

For a week now demonetization of high value notes has been polarizing the country between those who totally support the idea and those who are against it. The move has had a big impact on the stocks markets. A lot of investors are withdrawing capital from stocks. Some...

Making money in stocks is often not about stock market investing

There are times when anyone who has read half a book on finance can tell you that stock prices are unreasonably high. Of course, it is possible that prices keep moving higher despite such assurance. For this reason, it is often a good approach to stay invested...

Eicher Motors Stock Analysis

Eicher Motors Limited (“Eicher Motors” or the “Company”) is a leading player in the Indian automotive space. It operates in three distinct business verticals – Motorcycles, Commercial Vehicles and Personal Utility Vehicles. [1] Motorcycles– EicherMotors owns the...

Rules for Selecting a PMS Scheme

These days investors are looking at PMS Schemes as a more viable option to mutual funds. Particularly where the ticket size is above Rs. 25 lakhs. One clear advantage of selecting a PMS scheme is your ability to tailor the product as per your risk profile. This may...

NRI Investment in Indian Mutual Funds

Non Residents Indians (NRIs) can benefit from a growing home economy by investing in mutual fund schemes in India. In case of NRI Investment in Indian Mutual Funds no special approval is to be sought from authorities such as the RBI. They can invest in mutual funds on...

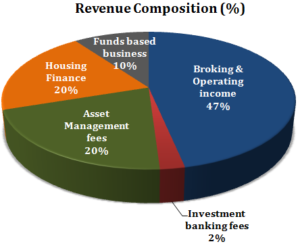

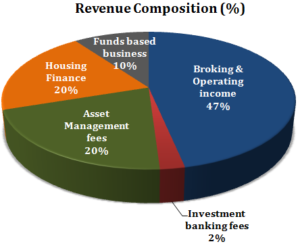

Motilal Oswal Financial Services Stock Analysis

Motilal Oswal Financial Services Ltd (“Motilal Oswal” or the “Company”) is a diversified financial services group focused on wealth creation through knowledge. The Company provides a whole host of products and services across retail broking & financial products...

Share Split vs. Bonus Issue – Impact on Shareholders

Share Split – When a company declares a share split, the number of outstanding shares increases, but the market capitalization remains the same. This involves division of equity shares by lowering their face value. After share split, Earning per Share (EPS) of the...

Financial Advisors are for your benefit – Here’s What You Should Know

Financial Advisors do not charge you commission, they save you money. I have had many cases where (potential) clients call in for advice, extract limited guidance and disconnect thinking they do not need a financial advisor once they knew his broad view, or as it...

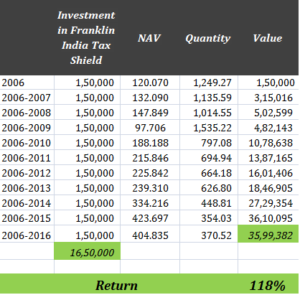

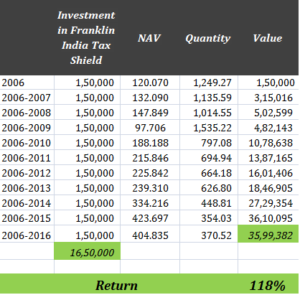

ELSS vs PPF – What Should You Choose?

Public Provident Fund (PPF) Equity Linked Savings Schemes (ELSS) Type Bank Account Mutual Fund Exemption Up to Rs. 1,50,000 investments per year are exempt from Income Tax under section 80CC Up to Rs. 1,50,000 investments per year are exempt from Income Tax under...

Top Monthly Income Plans in India

Monthly Income Plans (MIPs) are debt oriented mutual funds, which invest a small part of the fund (15-25 %) in equities. MIPs offers regular income in the form of periodic (monthly, quarterly, half-yearly) dividend payouts. Investors can invest in MIPs with two...

Demonetization: Impact on stock markets

For a week now demonetization of high value notes has been polarizing the country between those who totally support the idea and those who are against it. The move has had a big impact on the stocks markets. A lot of investors are withdrawing capital from stocks. Some...

Making money in stocks is often not about stock market investing

There are times when anyone who has read half a book on finance can tell you that stock prices are unreasonably high. Of course, it is possible that prices keep moving higher despite such assurance. For this reason, it is often a good approach to stay invested...

Eicher Motors Stock Analysis

Eicher Motors Limited (“Eicher Motors” or the “Company”) is a leading player in the Indian automotive space. It operates in three distinct business verticals – Motorcycles, Commercial Vehicles and Personal Utility Vehicles. [1] Motorcycles– EicherMotors owns the...

Rules for Selecting a PMS Scheme

These days investors are looking at PMS Schemes as a more viable option to mutual funds. Particularly where the ticket size is above Rs. 25 lakhs. One clear advantage of selecting a PMS scheme is your ability to tailor the product as per your risk profile. This may...

NRI Investment in Indian Mutual Funds

Non Residents Indians (NRIs) can benefit from a growing home economy by investing in mutual fund schemes in India. In case of NRI Investment in Indian Mutual Funds no special approval is to be sought from authorities such as the RBI. They can invest in mutual funds on...

Motilal Oswal Financial Services Stock Analysis

Motilal Oswal Financial Services Ltd (“Motilal Oswal” or the “Company”) is a diversified financial services group focused on wealth creation through knowledge. The Company provides a whole host of products and services across retail broking & financial products...

Share Split vs. Bonus Issue – Impact on Shareholders

Share Split – When a company declares a share split, the number of outstanding shares increases, but the market capitalization remains the same. This involves division of equity shares by lowering their face value. After share split, Earning per Share (EPS) of the...

Financial Advisors are for your benefit – Here’s What You Should Know

Financial Advisors do not charge you commission, they save you money. I have had many cases where (potential) clients call in for advice, extract limited guidance and disconnect thinking they do not need a financial advisor once they knew his broad view, or as it...

ELSS vs PPF – What Should You Choose?

Public Provident Fund (PPF) Equity Linked Savings Schemes (ELSS) Type Bank Account Mutual Fund Exemption Up to Rs. 1,50,000 investments per year are exempt from Income Tax under section 80CC Up to Rs. 1,50,000 investments per year are exempt from Income Tax under...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter