Blog

Blog

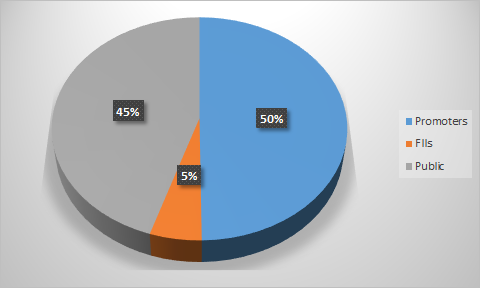

Should You Invest In Lincoln Pharma

Lincoln Pharma stands out as a compelling investment opportunity, driven by its strong growth prospects, robust financial health, and undervalued valuation. The company’s strategic focus on product innovation, geographic expansion, and operational excellence positions...

Unicommerce: Profiting from E-Commerce Boom

Unicommerce Dominant Market Leader in a Growing Industry: Unicommerce stands as India's largest e-commerce enablement SaaS platform in the transaction processing layer, boasting an impressive annual transaction run rate exceeding 931 million. Their financial...

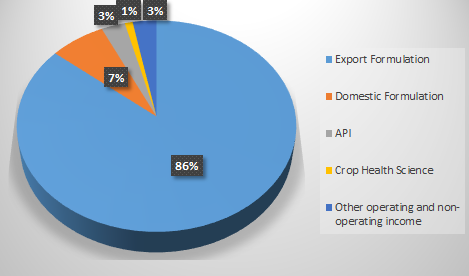

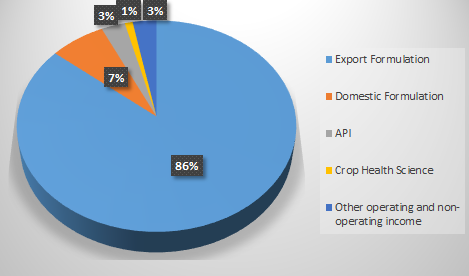

Natco Pharma: Key Growth Drivers and Future Prospects

Natco Pharma has established itself as a premier player in the complex generics space, focusing on high-barrier, niche products that face limited competition. The company has grown substantially through its diversified portfolio across Export formulations, Domestic...

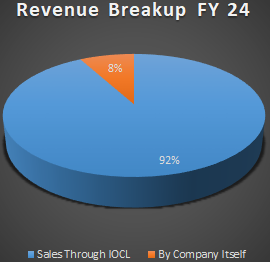

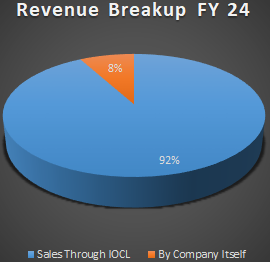

Should You Invest In Chennai Petro Corporation Limited?

Chennai Petroleum Corporation Limited (Chennai Petro), a subsidiary of Indian Oil Corporation, is a key player in India’s downstream oil and gas sector, primarily engaged in refining crude oil and manufacturing petroleum products. Given the evolving energy landscape,...

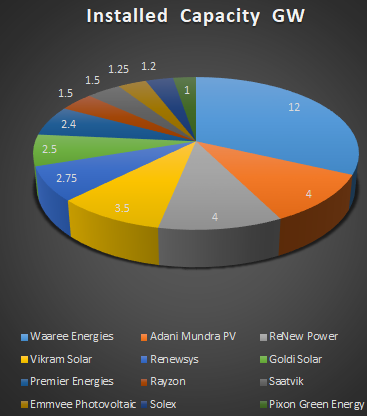

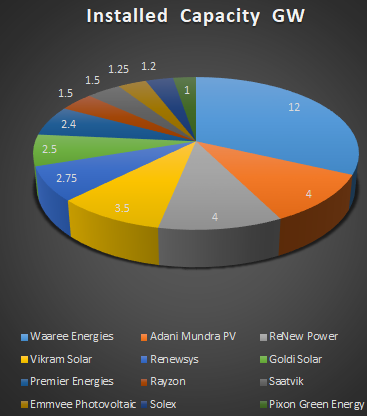

Waaree Energies: Opportunity in the High-Growth Solar Sector

Unless you're living under a rock or you're a total novice to the investing community, you would have heard about the Hot IPO of WAAREE ENERGIES ~Fun Fact Waaree Energies IPO broke the record by receiving the highest number of applications for an IPO at 97.34 lakh....

China Market Rebound: Opportunity or Risk for Investors?

Over the past week, the Hang Seng Index and the CSI 300 Index of china have experienced a dramatic reversal, transforming significant one-year declines into robust gains within days. Market sentiment has shifted decisively from a stance of "Anything But China" to "All...

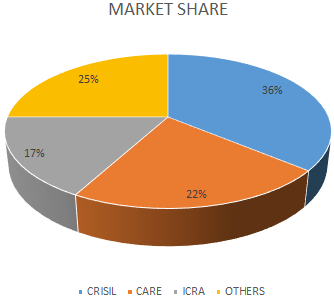

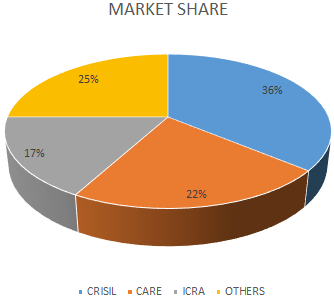

Credit Rating Industry in India A Sunset Sector?

Credit rating business has fantastic economics. They enjoy superior operating margins in ~30% consistent, solid return ratios i.e Return on equity of about 30%. The business requires no debt. The only expense on their books is qualified personnel. FINANCIAL STATEMENT...

What are Invits and should You Invest In them

Had you invested in the IPO of INVITS, How much return would you have earned? INVIT FUND IPO Date Issue Price Cumulative Distribution Price as of (31-03-2024) Annualized return IRB INVIT FUND May-17 100 66.4 68 4.30% INDIGRID May-17 100 87.4 133 15% POWER GRID INVIT...

India’s Top Monopoly and Near-Monopoly Businesses

You may have heard enough about buying monopoly businesses or businesses with a strong economic moat which can not be replaced. The article below presents examples of some such monopoly businesses in India. Company Name Market Share Description Coal India 82% market...

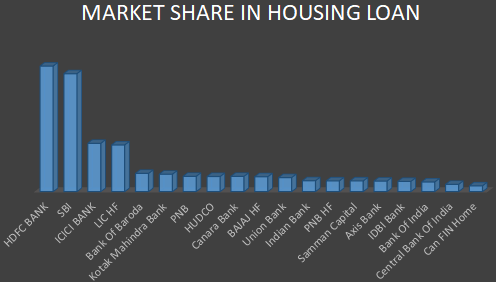

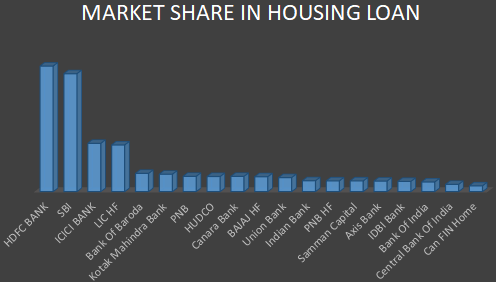

Which Housing Finance Company To Invest In?

Share of Housing Finance market - Here's a list of players by the quantum of home loans. Housing Finance companies LOAN OUTSTANDING/AUM As of Mar-24 Rs in Cr PE Market Cap Market Share HDFC BANK ₹ 7,72,786.00 18.96 ₹ 12,92,266.29 22.208% SBI ₹ 7,25,818.00 9.71 ₹...

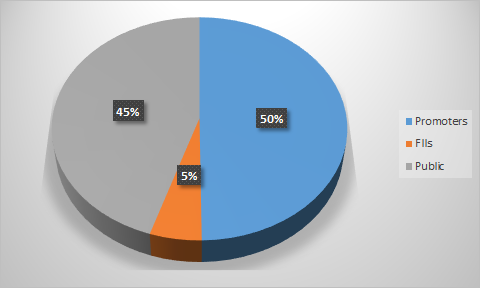

Should You Invest In Lincoln Pharma

Lincoln Pharma stands out as a compelling investment opportunity, driven by its strong growth prospects, robust financial health, and undervalued valuation. The company’s strategic focus on product innovation, geographic expansion, and operational excellence positions...

Unicommerce: Profiting from E-Commerce Boom

Unicommerce Dominant Market Leader in a Growing Industry: Unicommerce stands as India's largest e-commerce enablement SaaS platform in the transaction processing layer, boasting an impressive annual transaction run rate exceeding 931 million. Their financial...

Natco Pharma: Key Growth Drivers and Future Prospects

Natco Pharma has established itself as a premier player in the complex generics space, focusing on high-barrier, niche products that face limited competition. The company has grown substantially through its diversified portfolio across Export formulations, Domestic...

Should You Invest In Chennai Petro Corporation Limited?

Chennai Petroleum Corporation Limited (Chennai Petro), a subsidiary of Indian Oil Corporation, is a key player in India’s downstream oil and gas sector, primarily engaged in refining crude oil and manufacturing petroleum products. Given the evolving energy landscape,...

Waaree Energies: Opportunity in the High-Growth Solar Sector

Unless you're living under a rock or you're a total novice to the investing community, you would have heard about the Hot IPO of WAAREE ENERGIES ~Fun Fact Waaree Energies IPO broke the record by receiving the highest number of applications for an IPO at 97.34 lakh....

China Market Rebound: Opportunity or Risk for Investors?

Over the past week, the Hang Seng Index and the CSI 300 Index of china have experienced a dramatic reversal, transforming significant one-year declines into robust gains within days. Market sentiment has shifted decisively from a stance of "Anything But China" to "All...

Credit Rating Industry in India A Sunset Sector?

Credit rating business has fantastic economics. They enjoy superior operating margins in ~30% consistent, solid return ratios i.e Return on equity of about 30%. The business requires no debt. The only expense on their books is qualified personnel. FINANCIAL STATEMENT...

What are Invits and should You Invest In them

Had you invested in the IPO of INVITS, How much return would you have earned? INVIT FUND IPO Date Issue Price Cumulative Distribution Price as of (31-03-2024) Annualized return IRB INVIT FUND May-17 100 66.4 68 4.30% INDIGRID May-17 100 87.4 133 15% POWER GRID INVIT...

India’s Top Monopoly and Near-Monopoly Businesses

You may have heard enough about buying monopoly businesses or businesses with a strong economic moat which can not be replaced. The article below presents examples of some such monopoly businesses in India. Company Name Market Share Description Coal India 82% market...

Which Housing Finance Company To Invest In?

Share of Housing Finance market - Here's a list of players by the quantum of home loans. Housing Finance companies LOAN OUTSTANDING/AUM As of Mar-24 Rs in Cr PE Market Cap Market Share HDFC BANK ₹ 7,72,786.00 18.96 ₹ 12,92,266.29 22.208% SBI ₹ 7,25,818.00 9.71 ₹...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter