Credit rating business has fantastic economics. They enjoy superior operating margins in ~30% consistent, solid return ratios i.e Return on equity of about 30%. The business requires no debt. The only expense on their books is qualified personnel.

FINANCIAL STATEMENT ANALYSIS (Rs in Cr)

| CRISIL | Dec-19 | Dec-20 | Dec-21 | Dec-22 | Dec-23 | TTM |

| Sales | 1,732 | 1,982 | 2,301 | 2,769 | 3,140 | 3,189 |

| OPM % | 26% | 26% | 27% | 26% | 28% | 27% |

| Net Profit | 344 | 355 | 466 | 564 | 658 | 650 |

| ICRA | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

| Sales | 328 | 321 | 301 | 343 | 403 | 446 |

| OPM % | 34% | 30% | 27% | 35% | 35% | 33% |

| Net Profit | 106 | 97 | 83 | 114 | 137 | 152 |

| CARE | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

| Sales | 319 | 244 | 248 | 248 | 279 | 332 |

| OPM % | 55% | 33% | 39% | 32% | 36% | 34% |

| Net Profit | 138 | 83 | 91 | 77 | 85 | 103 |

WHAT ARE CREDIT RATING AGENCIES

Credit rating agencies assign credit risk ratings to individual companies, stocks, government, corporate, or municipal bonds, mortgage-backed securities, credit default swaps, and collateralized debt obligations. Credit risk shows how likely a borrower is to default on their obligations to repay a loan.

Higher-rated securities For example, AAA is considered the industry standard as the highest rating, and, AA, A, and BBB are widely seen as investment-quality securities.

However, it is generally accepted that AAA and AA-rated securities have a default risk of less than 1%, and the probability of default increases for each subsequent rating.

Ratings of BB or below are speculative grades that denote a higher credit risk or risk of default in the underlying security, but this often comes with a potentially higher return on an initial investment.

The following are the major credit rating agencies listed on an exchange

- CRISIL – A subsidiary of S&P Global

- CARE Ratings- The second-largest rating agency in India

- ICRA – A subsidiary of Moody’s

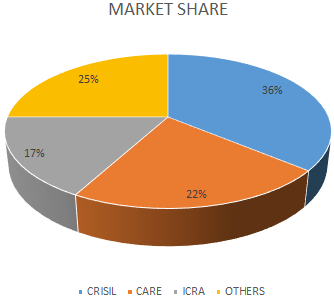

The credit rating market is an oligopolistic market with the top 3 rating agencies making the bulk of the market. Their relative sizes are mentioned below

CRISIL is by far the largest and the most respected/relied credit rating agency amongst all the credit rating agencies followed by CARE Ratings with Market share of 22% and ICRA with 17%.

Revenue from Rating Business (Rs in CR)

| Particulars | Dec-19 | Dec-20 | Dec-21 | Dec-22 | Dec-23 | Dec-24 | CAGR@5YR |

| CRISIL | 545 | 565 | 604 | 663 | 772 | 885 | 10% |

| Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | ||

| CARE | 300 | 220 | 220 | 228 | 262 | 298 | 0% |

| ICRA | 230 | 210 | 180 | 190 | 230 | 218 | -1% |

| TOTAL | 1075 | 995 | 1004 | 1081.4 | 1264.4 | 1401 | 5% |

Given its Rosy picture and positive outlook for the credit rating industry, the industry has seen revenue growth of around 5%, the performance of CARE Ratings and ICRA has stagnated over the past five years. In contrast, CRISIL has emerged as the only clear winner, experiencing a “flight to quality” in its rating business i.e. the market moves to the leader than others during difficult times.

Analysis of profitability will also another show interesting trend, as CRISIL can command better margins in difficult time. This probably signifies that during difficult times ( e.g. ILFS crisis/ loss of trust), in the industry trust is all that is demanded, and leader commands pricing power

This divergence is largely due to the reputational damage suffered by CARE and ICRA, stemming from their involvement in high-profile scandals such as IL&FS, DHFL , ZEE, and RCOM. These incidents have significantly tarnished the credibility of their credit rating processes and the quality of their ratings. While CRISIL has continued to gain market share, CARE and ICRA are still grappling with the impact of these events and working to restore their reputations.

STOCK PRICE PERFORMANCE

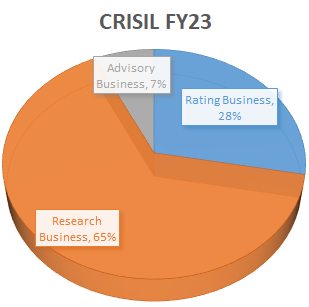

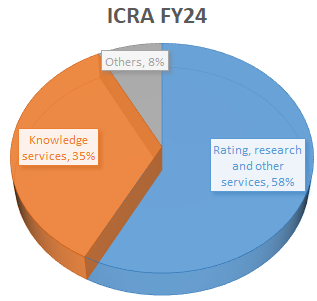

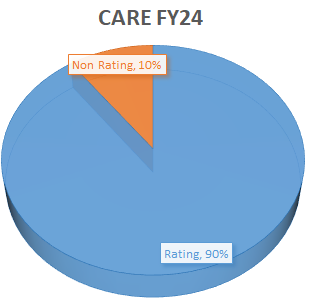

While CRISIL and ICRA have delivered a 9% return, CARE has struggled to generate positive returns, posting a -2% CAGR over the past 10 years. This underperformance can be attributed to CARE’s focus as a pure-play rating business, whereas CRISIL and ICRA benefit from diversified revenue streams supported by their parent companies, S&P and Moody’s, respectively. For CRISIL, a significant portion of its revenue (over 65%) comes from its analytics and research business, heavily supported by S&P. In contrast, CARE still relies on credit rating services for approximately 90% of its revenue, despite efforts to diversify. Unless CARE pivots away from being solely a rating agency, it may face significant challenges in achieving the revenue growth seen by CRISIL.

REVENUE BIFURCATION

| Name | CMP Rs.(28-08-24) | P/E | Mar Cap Rs.Cr. | ROE % | PEG | All Time High |

| CRISIL | 4538.05 | 51.07 | 33189.9 | 32.3 | 4.16 | 5068 |

| ICRA | 5891.55 | 38.81 | 5678.89 | 15.64 | 5.18 | 6149 |

| CARE Ratings | 990.65 | 28.67 | 2965.87 | 14.47 | -4.77 | 1716 |

CARE RATING PRICE CHART

The credit rating sector experienced strong growth in the past, primarily driven by credit upcycle following the implementation of Basel II norms and stringent Insolvency and Bankruptcy code as more companies were going for rating gradually, which led to very high growth. Proportion of new business as compared to surveillance business was higher that time.

The credit rating sector has largely matured, with most companies already rated. New business opportunities are limited, Now with significant dent in reputation credit ratings have lost there credibility. The market for new credit ratings could stagnate, and competition may intensify, putting pressure on margins.

While credit growth does lead to rating business growth, the same can not be similar, due to pricing cap and fee negotiation with increased quantum of debt.

In our view, future growth in rating business will be lower than credit growth. CRISIL was visionary to understand this much earlier and aggressively expanded other business areas.

Despite CARE and ICRA trading at lower valuations compared to CRISIL, these discounts do not necessarily signal good value. CARE Ratings, for instance, saw a 50% stock price crash in 2018, reflecting deep concerns about its business model. Over the last five years, CARE’s revenue grew by just 4%, while its profitability declined by 25%. Its market share has decreased as CRISIL’s has grown.

If this trend persists, CARE Ratings may continue its decline into deep value territory, whereas CRISIL, with its diversified growth strategy, could evolve into a super-growth stock.

Despite the immense utility of credit ratings, doubts have been cast on their reliability and accuracy.

- Credit Rating Agencies (CRAs) face significant conflicts of interest because they are employed by the issuers to rate their financial instruments. Regulators have explored various models, such as the investor-paid model, in an attempt to address this conflict of interest issue. However, so far, no model has been found to be as effective as the issuer-paid model, despite its inherent conflict of interest.

- Several instances where Credit Rating Agencies have been implicated in high-profile scandals.

- CRAs often lag behind market indicators as CRAs do not maintain adequately updated ratings.

- One study analyzed 248 companies of the BSE and concluded that a gap existed between the credit ratings issued to different companies and their financial ratios, raising doubts regarding the correctness of these ratings.

- Due to intense competition Rating shopping has been one of the major concerns i.e when an issuer solicits ratings from multiple CRAs but only pays for one that discloses the highest rating.

Several instances where Credit Rating Agencies have been implicated in high-profile scandals.

Here is the entire Timeline of what happend in the IL&FS case

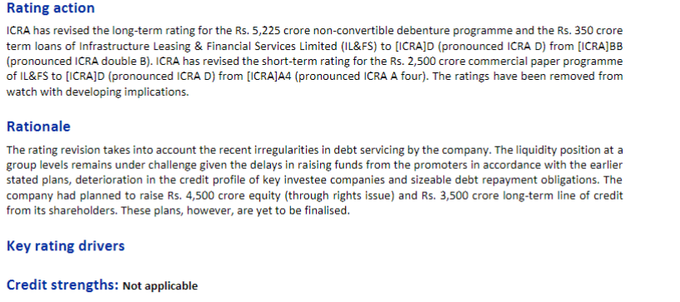

March 27, 2018: All is well in the world. ICRA has just given an A1+ rating to ILFS commercial paper for Rs 2,500 crore. Long term loans and non convertible debentures are assigned AAA (outstanding) rating with stable *long term* outlook.

ICRA says that its rating is because of the long history of ILFS business, strong brand, demonstrated track record as well as experience of its management. Note these words. They play a key role in this story.

Same report: ICRA believes IL&FS Limited would continue to benefit from its experienced senior management team and its significant track record of operations in the infrastructure domain.

August 6, 2018: ICRA re-affirms the A1+ rating on the commercial paper but downgrades long term loans and debentures from AAA to AA+. Outlook is still good. ” And management is awesome, prudent and track record is well demonstrated.

August 16, 2018: ICRA has now rated a new non-convertible debenture program of Rs 750 crore with AA+ rating while all other ratings of A1+ and AA are reaffirmed in the release. Remember the praise for the management and the company? It’s copy pasted here as well.

September 7: ILFS has just finished a day long board meeting. Its board is trying hard to raise additional funds from shareholders like LIC and SEBI but a fully day of meeting doesn’t come to a conclusion. It needs funds because ILFS financial services just defaulted on SIDBI.

September 8: ICRA downgrades the debentures it rated in A category just 2 weeks ago to BB while commercial paper comes down to A4 and long term loans are stable at BB. The ratings are still factoring in ILFS long history, strong management and domain expertise, we are told.

September 8 – September 17: Things go downhill fast for ILFS. The company has started defaulting on its commercial papers and other debt obligations are next in line. There’s a scramble to raise money to keep it running but no one is forthcoming.

September 17, 2018: ICRA wakes up to the reality. Debentures go from BB to D, commercial paper from A4 to D and long term loans from BB to D. ICRA says that the company is planning to raise funds but the plans are not yet finalised

Remember that copy-pasted schpeel about strong management, great company and experienced board in ICRA releases so far? THAT GOES MISSING.

There are no more credit strengths about ILFS that the ICRA can rely on to continue to give ratings.

So, we are told that ICRA will stop watching ILFS from now on, washing its hands off. The fascinating bit about this is that it took NINE DAYS. 9 days for BB ratings to become D. 9 days for management strength and brand to vanish. 9 days for ICRA to stop watching the company.

The SEBI probe also found that CARE Ratings while issuing the rating to the instruments of IL&FS failed to do proper Due Diligence

On the insistence of SEBI, when the enquiry was pending, both CARE Ratings and ICRA asked their respective MD&CEO to go on leave in Jul-19.

A few months later, ICRA removed its MD&CEO – Mr. Naresh Thakkar in Aug-19 and the MD&CEO of CARE Ratings – Mar. Rajesh Mokashi has resigned from services in Dec-19.

DHFL CASE

Three months before its collapse in June 2019, DHFL’s rating was “AA+” by CARE Ratings. It was changed to “D” when the company defaulted to repay its Rs 8.5 bn of outstanding Commercial Paper (CP) out of which Rs 7.5 bn was due in June 2019.%

Deccan Chronicle Fiasco

CARE awarded AA and A1+ ratings to various instruments of DCHL. An AA rating (for long- and medium-term instruments) signifies “high degree of safety” regarding “timely servicing of financial obligations” according to the agency’s website. An A1+ rating is the highest for short-term debt instruments and “carry the lowest credit risk”.

The ratings were altered a week after DCHL first defaulted on a payment on 26 June, but by then, the damage had been done. Subsequently, CARE even suspended the ratings as “the company was not cooperating