The power sector is poised for significant growth. Despite investing Rs. 111 lakh crore (US$ 1.4 trillion) in capital expenditures, with energy projects constituting approximately 24% of the total expenditure, an additional Rs. 33 lakh crore (US$ 400 billion) will be needed. Furthermore, by 2032, the sector will require 3.78 million skilled professionals to meet the increasing energy demands.

It is a no-brainer that Power grids require upgrades to accommodate new clean energy resources, with transformers serving as a critical component of this modernization.

The industry has yet not reached its full potential as only 10% of the necessary work has been completed, leaving 90% of the transmission infra development still to be addressed.

Overview of India’s Renewable Energy and Power Sector Developments (2020-2030)

| CEA Distribution System Plan (2030) | Details | |

|---|---|---|

| Installed Renewable Capacity (Mar 24) | 210 GW ~46% of total installed capacity | |

| Capacity Growth (2024 to 2030) | Increase from 210 GW (Mar 2024) to 500 GW (Mar 2030).

|

| Power Sub-Station Development (2022–2030) | Details |

|---|---|

| Current Statistics (Mar 31, 2022) | 39,965 power sub-stations with 4,82,810 MVA capacity. |

| Planned Expansion (2022–2030) | 12,192 new sub-stations with 1,41,522 MVA capacity. |

| Cumulative Capacity by 2022–30 | 6,24,332 MVA (29.31% increase compared to 2022). |

India’s Energy Transition Capex Requirement FY24- 50E

| Category | Capex Opportunity (US$ Billion) | Capex Share (%) |

| Solar | 690 | 41% |

| Transmission | 524 | 31% |

| Wind | 188 | 11% |

| Pumped Storage | 101 | 6% |

| Battery Storage | 102 | 6% |

| Electrolyser | 63 | 4% |

One such company that has recently entered the transformer industry is Danish Power.

About the company

Danish Power is an ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certified manufacturer specializing in various transformers and electrical control systems. Their product range includes Inverter duty transformers for renewable energy projects like solar and wind farms and Power and Distribution transformers. Additionally, they provide control relay panels and substation automation services.

Revenue Mix

- Inverter Duty Transformer ~ 69.17%

- Distribution Transformer ~ 25.47%

- Control Relay Panel ~ 3.85%

- Others ~ 1.52%

An Inverter duty transformer is a key component of solar power that converts the direct current electricity generated by solar panels into AC electricity –

Solar panels and inverters generate low to medium voltage DC, Inverter duty transformers step up this AC voltage to higher levels.

Inverter duty transformer opportunity in solar park –

For every 1 MW of solar capacity, 1.1 MVA of transformers is required. Installing 280 GW of solar capacity would translate to a demand of approximately 308,000 MVA for IDT transformers. This estimate excludes export opportunities, indicating a substantial demand for IDT transformers.

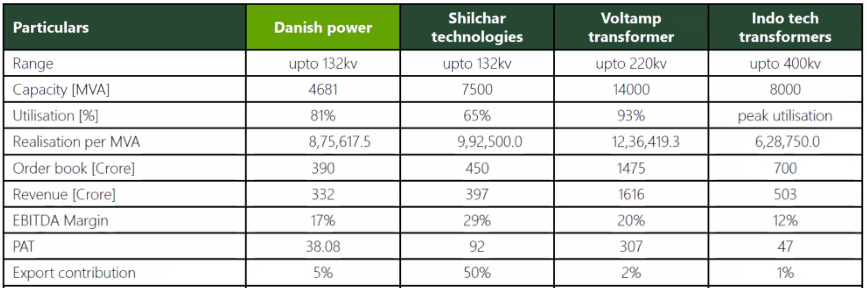

Peer Comparison just to put things in perspective

All the stakeholders in the industry have announced aggressive capex plans to cater to the upcoming demand

| Present MVA | Expected MVA | |

| Danish Power | 4681 | 11000 |

| Voltamp Transformers | 14000 | 20000 |

| Supreme Power | 2500 | 9500 |

| Transformers & Rectifiers India | 40000 | 65000 |

| Indo Tech Transformers | 8000 | 10000 |

| Name | CMP (₹) | P/E | Ind PE | Market Cap (₹ Cr.) | PEG | EV/EBITDA | ROCE (3 Yr Avg %) | Asset Turnover |

| T R I L | 1061.35 | 131.82 | 65.18 | 15929.05 | 2.31 | 66.97 | 13.3 | 1.1 |

| Danish Power | 1131.1 | 58.6 | 65.18 | 2227.32 | 1.01 | 38.89 | 38.6 | 2.48 |

| Shilchar Tech. | 8145.45 | 57.62 | 65.18 | 6212.37 | 0.9 | 41.59 | 50.73 | 1.69 |

| Indo Tech. Trans. | 2986.55 | 52.97 | 65.18 | 3171.72 | 1.06 | 38.2 | 23.05 | 1.46 |

| Supreme Power | 224.3 | 38.21 | 65.18 | 560.55 | 0.35 | 26.06 | 40.94 | 1.33 |

| Volt. Transform. | 10224.15 | 30.13 | 65.18 | 10343.9 | 1.03 | 22.22 | 25.13 | 1.18 |

What Lies Ahead for Danish Power

The revenue and profitability outlook for Danish Power appears promising, and here’s an estimate of how things could unfold.

In the transformers industry, the seasonal pattern has consistently shown a trend of H1<H2. To understand this better, let’s look at half-yearly numbers for some listed transformer companies in FY24:

- Shilchar: H1 ₹173 crore, H2 ₹223 crore

- Indotech: H1 ₹189 crore, H2 ₹314 crore

- Transformers & Rectifiers India: H1 ₹413 crore, H2 ₹882 crore

- Voltamp: H1 ₹703 crore, H2 ₹912 crore

This trend is not just a one-off; companies in this sector typically generate 60%-70% of their annual revenues in the second half.

Danish Power reported ₹163 crore in H1FY25 revenue. Extrapolating this trend, assuming 60% of the revenue comes in H2FY25, the full-year number comes to about ₹407 crore. The management has also guided for at least 20% growth over their ₹332 crore FY24 revenue, putting FY25 estimates in the range of ₹400-425 crore.

Danish Power’s installed capacity for transformers is 4681 MVA. Factoring in ₹30 crore from panels (flat compared to last year), a strong order book suggests the company is on track to deliver revenues of ₹400-425 crore this year. This translates to an EBITDA of approximately ₹75-80 crore and a net profit of about ₹50 crore for FY25, even without considering the upcoming capacity expansion set to go live in Q4.

Looking ahead, once the capacity expansion becomes operational, Danish Power’s total capacity will rise to 11,000 MVA. At the current 81% utilization and a realization of ₹9 lakh per MVA:

11,000 MVA x 81% utilization x ₹9,00,000 per MVA = ₹800 crore revenue

Even at an optimal utilization of the new capacity and full utilization of the existing capacity, Danish Power could realistically achieve ₹700 crore revenue in FY26, a significant leap forward.

Currently trading at a TTM P/E of 58.6, Danish Power’s valuation might appear high. However, based on FY26 projections, it emerges as one of the cheapest options in the transformer space, offering substantial growth potential.

What’s even more exciting is that the company has recently received huge orders.

- First Order in the European Market

Danish Power has successfully secured its first-ever order from the European market, signaling that the necessary regulatory approvals are now in place. This development positions the company closer to tapping into the high-potential export market. Currently, exports contribute just 5% of total revenues, but this figure could expand to as much as 20% in the coming years. If this happens, margins could witness a sharp uptick, especially post-capacity expansion. - Securing ₹100 Crore in Solar-Related Orders

The company has also secured multiple large-scale orders for inverter duty transformers, catering to over 1 GW of solar power projects. These orders, estimated to be worth approximately ₹100 crore, highlight Danish Power’s growing presence in the renewable energy sector.- Order Details:

- The transformers are to be supplied to EPC companies and developers across Rajasthan, Gujarat, and Andhra Pradesh.

- Deliveries are expected to take place between January and May 2025.

- Order Details:

Our Investment Case

Danish Power presents a compelling investment case with strong growth potential driven by:

- Strategic Positioning: Located in Jaipur, Rajasthan—the largest hub for solar parks—Danish Power has a natural advantage in delivering transformers faster and at lower costs, enhancing its competitive edge.

- Domain Expertise: The leadership, particularly MD Shivam Talwar, brings deep industry expertise, reflected in the company’s focused execution and innovative growth strategies.

- Solid Financials and Expansion Plans: Danish Power demonstrates superior working capital management, second only to Shilchar, enabling better margins. Its capacity expansion to 11,000 MVA positions it to achieve ₹700-800 crore in revenue by FY26.

- Growing Demand and Export Potential: Recent orders, including entry into the European market, highlight export potential, while domestic demand for renewable energy infrastructure supports sustainable growth.

Trading at a relatively attractive valuation compared to peers, Danish Power stands out as a growth-oriented player in a sector poised for transformative expansion.

0 Responses

nice write-up, in the last line- attractive valuation compared to peers: can you add danish vs shilchar comparision on forward pe basis?

What is the source of this 11,000 MVA expansion plan?