Natco Pharma has established itself as a premier player in the complex generics space, focusing on high-barrier, niche products that face limited competition.

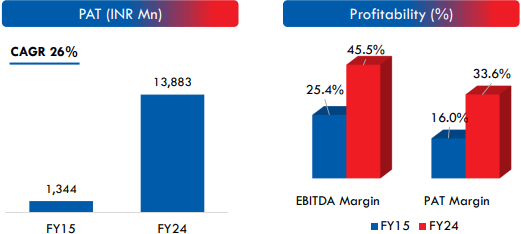

The company has grown substantially through its diversified portfolio across Export formulations, Domestic formulations, APIs, and Crop Health Sciences, positioning itself strongly in the global generics market. Key to Natco’s future growth are its targeted expansion efforts in oncology and chronic disease therapeutics, alongside a robust pipeline that includes high-potential drugs like Olaparib, Erdafitinib, Carfilzomib, and Semaglutide.

| Metric | Value |

| Market Cap | ₹ 26,706 Cr. |

| Stock P/E | 13.7 |

| Current Price | ₹ 1,491 |

| ROCE | 34.20% |

| ROE | 23.70% |

| PEG Ratio | 0.92 |

| Dividend Yield | 0.66% |

| Debt to equity | 0.06 |

Natco Pharma trading at a P/E of 13.7, appears undervalued relative to its peers, particularly given its unique positioning in complex generics, high EBITDA margin, and robust R&D pipeline make it a compelling investment with significant upside potential. With a strong financial performance, a healthy cash position, and expansion efforts across multiple geographies, Natco Pharma offers an attractive long-term growth prospect for investors.

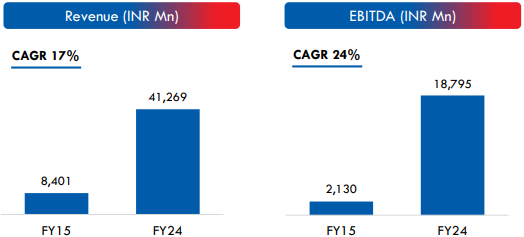

KEY PERFORMANCE INDICATOR

Strategic Acquisitions and Expansion Plans

The company’s cash reserves of ₹2,000 crores enhance its ability to deploy capital effectively, Natco is actively exploring acquisitions in Rest-of-World (RoW) markets to diversify its revenue base. Such acquisitions, if successful, could accelerate Natco’s global expansion efforts and reduce reliance on the U.S. market.

Industry Outlook

The global pharmaceutical industry, especially the generic sector, is characterized by increasing competition and regulatory scrutiny. However, companies that focus on high-barrier generics, such as Natco, are well-positioned to capture market share due to their limited competition and market exclusivity. The shift towards complex generics is likely to benefit Natco, given its expertise in handling intricate chemistries and manufacturing requirements. Moreover, rising demand for generics across emerging markets further bolsters the sector’s long-term growth prospects.

Key Catalyst: Ozempic (Semaglutide) and Revenue Potential

Natco Pharma’s development of generic Semaglutide, marketed as Ozempic, represents a potentially transformative revenue source. Ozempic, a GLP-1 receptor agonist for diabetes and weight management, has seen a surge in demand globally. With obesity and diabetes rates rising, the GLP-1 market is projected to grow significantly, providing Natco with an opportunity to tap into a high-growth area in the pharmaceutical industry.

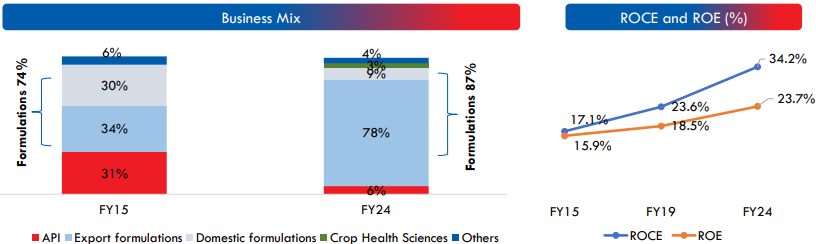

Financial Performance

The company reported robust earnings for Q1 FY25, with a consolidated revenue of ₹1,410.7 crores (up 21.6% YoY) and net profit of ₹668.5 crores (up 59% YoY). This growth was primarily driven by its U.S. generics segment, particularly from Revlimid, which contributed significantly to the overall revenue mix.

The recent EBITDA margin of 60.5% one of the highest among its peers represents the company’s ability to generate high profitability even in a competitive market.

For FY25, management anticipates at least a 20% growth in net profit, supported by new launches and expansion efforts.

Revenue Streams and Segment Analysis

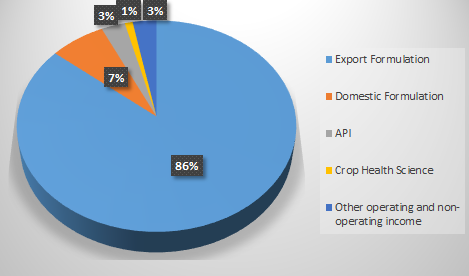

REVENUE BIFURCATION Q1FY25

- Export Formulations:

This is the primary revenue driver, accounting for about 86% of total revenue. The U.S. market, in particular, has been instrumental, with high-value products like generic Revlimid playing a significant role. Revenue from international subsidiaries contributed ₹1,210 crores in Q1 FY25 alone. Despite the inherent challenges, management expects this segment to remain resilient, supported by new FTF (First-to-File) approvals and upcoming launches. - Domestic Formulations:

Natco’s domestic formulations segment provides a steady revenue base, generating approximately ₹102 crores in Q1 FY25. The company anticipates stable growth of 8-10% in this segment, driven by its existing product portfolio and new additions to meet domestic demand. - API Business:

Though not a major revenue source, Natco’s API segment supports captive requirements, ensuring a stable supply for its formulations. Plans for capacity expansion and external sales may lead to gradual growth in this segment. - Crop Health Sciences:

Natco’s entry into the crop health sciences market represents a diversification strategy. This segment, which generated ₹15.6 crores in Q1 FY25, is expected to reach annual sales of ₹250-300 crores within the next two to three years. Management remains optimistic about its long-term potential, particularly in India’s agriculture sector.

R&D Pipeline and Future Growth Drivers

Natco’s robust R&D pipeline includes high-value complex generics such as Olaparib, Erdafitinib, and Carfilzomib, alongside the promising Semaglutide. These products are anticipated to offset any revenue loss from Revlimid’s eventual patent expiration in FY27.

Key products like Olaparib (a PARP inhibitor used in cancer treatment) and Erdafitinib (targeting bladder cancer) have high growth potential in the oncology market. Semaglutide, given its blockbuster profile, is likely to become a cornerstone of Natco’s future portfolio, assuming successful market penetration.

Furthermore, Natco’s investment in emerging technologies like cell and gene therapy reflects its commitment to innovation. Collaborations with firms like Cellogen Therapeutics for advanced therapies signal its ambition to capture market share in high-growth areas, aligning well with industry trends.

Key Risks

- U.S. Market Dependence:

Natco’s reliance on the U.S. market for a large portion of its revenue makes it vulnerable to regulatory changes, pricing pressures, and competitive risks. Any unfavorable regulatory development could impact the financial performance of its core formulations segment. - Patent Expiration of Revlimid:

The loss of exclusivity on Revlimid in FY27 poses a substantial risk to Natco’s revenue stream. The company is focused on mitigating this by developing a strong pipeline, but the impact of this transition remains a key concern. - Regulatory Challenges:

Regulatory compliance is critical in the pharmaceutical industry, and Natco’s Kothur facility received a warning letter from the U.S. FDA in April 2024. While Natco is working to address these concerns, the warning could delay product launches and affect its profitability. - Currency Fluctuations:

Being export-oriented, Natco is exposed to currency exchange risks. Fluctuations in foreign exchange rates can influence profitability and lead to volatility in earnings.

0 Responses

Very nice study and detailed information about this gem in pharma industry.

NATCO has been audited by US FDA and is issued audit observations in US FDA Form 483.

There were serious lapses observed in manufacturing processes. Violation of cGMP.

This may delay its export to USA and filing of new drug application till audit observations are closed and Establishment Inspection Report (EIR) is issued.

What is your take on this.

Appreciate the range of coverage very happy..quite informative God bless you sir

Excellent coverage of business development through expansion & acquisition. various oportunities and threats are well discussed. Even key financials are also covered well but they are only upto Q1FY25 whereas at present we are in between end of Q3FY25. So if possible kindly cover current quarter financials for latest position.

The stock has fallen more than 30% in the last two days. what is your take on this?