Chennai Petroleum Corporation Limited (Chennai Petro), a subsidiary of Indian Oil Corporation, is a key player in India’s downstream oil and gas sector, primarily engaged in refining crude oil and manufacturing petroleum products. Given the evolving energy landscape, increasing domestic demand, and CPCL’s focus on sustainability, the company’s Price-to-Earnings (PE) ratio stands at 12.5 times, indicating the company’s undervaluation compared to its earnings.

| Metrics | Value |

| Market Cap | ₹ 8,960 Cr. |

| Stock P/E | 12.5 |

| ROCE | 35.10% |

| ROE | 35.90% |

| PEG | 0.17 |

| Debt to equity | 0.79 |

| Dividend Yield | 9.13 % |

With record dividends in recent years (₹55 per share in FY 2023-24 and ₹27 per share in FY 2022-23), This translates into an impressive dividend yield of 9.13%, underscoring the company’s robust cash flow generation and dedication to rewarding shareholders.

Investment Thesis and Buy Recommendation:

We recommend a Buy on Chennai Petro highlighting significant upside potential from CMP ₹602.

As a subsidiary of Indian Oil Corporation (IOCL), Chennai Petro benefits from strong parent backing, resource access, and an established distribution network. The company’s focus on capacity expansion, including high-margin products like Food Grade Hexane and Lube Oil Base Stocks, positions it well to capture additional market share and diversify revenue streams. Chennai Petro’s impressive debt reduction journey, with borrowings declining from ₹9,223 crore in FY 2021-22 to ₹2,762 crore in FY 2023-24, has also led to a robust improvement in its debt-to-equity ratio, reducing financial risk and supporting sustainable growth.

Positive Catalysts for Chennai Petro include timely capacity expansion, rising global refining margins, and growing integration of ESG initiatives, potentially attracting ESG-focused investments. With Chennai Petro has high capacity utilization and focus on operational efficiency, these initiatives are set to enhance both revenue and profitability, providing a favorable risk-reward profile for long-term investors.

Company Overview

- Chennai Petro, with a refining capacity of approximately 10.5 million metric tons per annum (MMTPA), is among India’s largest public-sector refiners. The company operates two refineries in Manali and Nagapattinam, which are well-positioned to serve both industrial and retail demands in southern India.

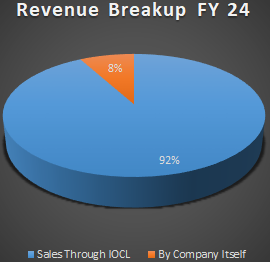

- The company’s core business is refining crude oil to produce a diverse range of petroleum products. These products are sold both directly to consumers and through IOCL, which acts as the primary marketing channel.

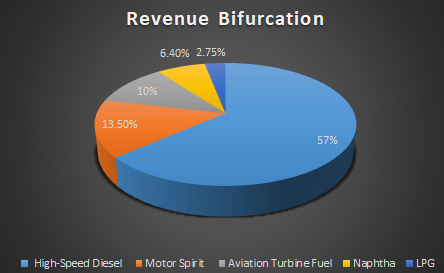

- Chennai Petro has a diverse product portfolio that includes high-value products such as LPG, Motor Spirit, Superior Kerosene, Aviation Turbine Fuel, High-Speed Diesel, Naphtha, Fuel Oil, Lube Base Stocks, and Bitumen.

- New Product Development: Production of specialty products like Lean Butene and ISROSENE, enhancing the product portfolio and increasing revenue streams.

- Focus on Specialty Products: Continued development and production of specialty products like Paraffin Wax, Mineral Turpentine Oil (MTO), Hexane, Petrochemical feedstocks, Linear Alkyl Benzene Feedstock (LABFS), Petroleum Coke and Sulphurl provides higher margins and diversification.

- The company’s geographical sales are predominantly concentrated in Southern India, specifically Tamil Nadu and parts of Andhra Pradesh, Telangana, and Karnataka. While Chennai Petro’s operations are entirely domestic, it occasionally exports products like High-Speed Diesel (HSD), Naphtha, and Lube Oil Base Stocks (LOBS) through IOCL when there’s excess supply

Revenue Bifurcation

The company has been expanding its production and refining capabilities with a particular emphasis on improving operational efficiency. Chennai Petro’s ambitious Cauvery Basin Refinery Project and other expansion initiatives aim to increase refining capacity and cater to higher demand in both domestic and export markets. These projects are likely to yield significant returns on investment, providing enhanced production capabilities and potentially better margin structures.

Capacity Utilization Rate

Chennai Petro achieved a capacity utilization rate of 111% in FY 2023-24. This signifies that the company’s refineries operated above their designed capacity, highlighting strong operational efficiency.

This accomplishment marks the second consecutive year that Chennai Petro has surpassed its nameplate capacity of 10.5 MMTPA (Million Metric Tonnes Per Annum). The highest-ever crude processing volume recorded was 11.642 MT, surpassing the previous record of 11.316 MT.

Financial Performance and Capital Allocation

Revenue and Profit Trends

| Particulars | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

| Sales | 22,222 | 43,068 | 76,271 | 66,024 |

| Expenses | 20,210 | 40,336 | 70,574 | 61,548 |

| Operating Profit | 2,012 | 2,732 | 5,698 | 4,476 |

| OPM % | 9% | 6% | 7% | 7% |

| Other Income | 127 | 26 | 13 | 47 |

| Interest | 376 | 413 | 331 | 224 |

| Depreciation | 466 | 504 | 573 | 606 |

| Profit before tax | 1,296 | 1,841 | 4,806 | 3,694 |

| Tax % | 80% | 27% | 27% | 26% |

| Net Profit | 257 | 1,352 | 3,532 | 2,745 |

| EPS in Rs | 17.28 | 90.79 | 237.16 | 184.34 |

- Revenue Growth: Sales grew sharply from ₹22,222 crore in FY 2020-21 to ₹76,271 crore in FY 2022-23, with a slight dip to ₹66,024 crore in FY 2023-24.

- Profitability: Operating margins held steady at 7% in FY 2023-24, though net profit saw a decline from ₹3,532 crore in FY 2022-23 to ₹2,745 crore in FY 2023-24.

- EPS Fluctuation: EPS rose from ₹17.28 in FY 2020-21 to a high of ₹237.16 in FY 2022-23, before reducing to ₹184.34 in FY 2023-24.

Key Risks

1. Volatile Refining Margins

Refining margins remain sensitive to fluctuations in crude oil prices, demand-supply imbalances, and global macroeconomic conditions. Any significant dip in these margins would impact Chennai Petro’s revenue and profit margins.

2. Regulatory and Environmental Pressures

India’s energy sector faces growing regulatory scrutiny, with new carbon markets and energy transition policies in development. Chennai Petro may incur additional costs to meet regulatory requirements, particularly as India aims to reduce its carbon footprint by promoting renewable energy. Failure to adapt to these regulatory changes could impact Chennai Petro’s profitability.

3. Climate Change and Operational Disruptions

Chennai Petro’s facilities are vulnerable to climate-related risks, such as extreme weather events that can disrupt operations. Chennai Petro has implemented risk management practices like GIS-based risk assessment and climate adaptation projects; however, unplanned shutdowns due to climate disruptions remain a significant risk..