Saregama: Stock Analysis

SAREGAMA VALUATION BASE CASE SCENARIO BEST CASE SCENARIO Saregama, a part of the RP-Sanjiv Goenka Group, a large conglomerate, is one of the oldest music label companies from India, among the likes of T-Series, Tips, Balaji Telefilms, etc with large intellectual property portfolio of 150K+ songs, 70+ films and web series, 6K+ hours of television […]

SHOULD YOU INVEST IN NYKAA?

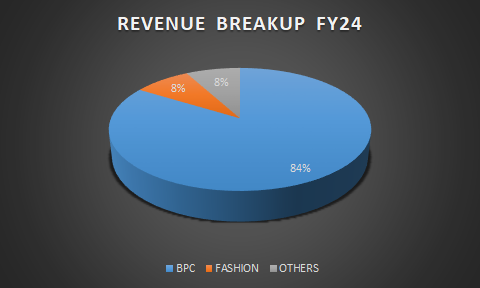

NYKAA TOP-DOWN ANALYSIS India is projected to become a ₹2,474 billion beauty and personal care opportunity by 2027 from ₹1506 billion in FY22 TOTAL ADDRESSABLE MARKET IN BPC FOR NYKAA The online BPC market is expected to grow at 29% CAGR over the next 5 years to ₹799 billion in 2027 from ₹227 billion in […]

Aster DM Healthcare- Stock Analysis

INVESTMENT THESIS Revised and from date of Original Publication: 16 July 2023 for news on Special Dividend ASTER DM has a unique business model with a presence in India’s growing healthcare industry and an established business with strong returns. Aster DM Healthcare has shifted its focus purely to India in the future, and we remain […]

Why is Unitech Stock Rising?

Unitech got into financial constraints and mismanagement as has been alleged sometime from 2013-2014 onwards, which resulted in non-delivery of sold units to the Homebuyers. This followed litigation at various fora and the promoters were lodged in jail in 2017. Finally, the Supreme Court intervened, which led to the supersession of the erstwhile management, replaced […]

Mold-Tek Packaging- Proxy play for FMCG and Pharma

VALUATIONS We maintain a positive view on Mold-Tek Packaging. Our Call – Buy We expect a 36% upside due to the company’s earnings being at an inflection point. Mold-Tek Packaging is expected to show superior volume growth and margin improvement, supported by capacity expansion and an improved revenue mix. We anticipate a robust PAT CAGR […]

Genus Power Infrastructure- Stock Analysis

Valuations- The company has guided for 1200 cr revenue and 16-17% margins in FY 24, at current valuations available at 4.73X Book and 36X EBDITA for FY 23. If the management fulfills its guidance, they are expected to generate around 192Cr EBITDA. Based on the company’s consistent track record of generating returns with a median […]

SULA VINEYARDS – STOCK ANALYSIS

Sula Vineyards – Industry leader with over 52% market share in the unfortified wine and 61% in the Elite and Premium segment. PEER COMPARISON INCOME STATEMENT VALUATIONS Sula Vineyards is trading at a cheap PE Multiple of 48.67, compared to its closest peers and is available at a PEG of 1.32. The company is currently […]

WHY DEEPAK NITRITE IS DOWN BY 25%- STOCK ANALYSIS

Deepak Nitrite Limited is one of India’s fastest growing and trusted chemical intermediates company with a diversified portfolio that caters to multiple industries with numerous applications. These products are widely used across end-user industries such as pharma, agrochemicals, plywood, paints, etc, and serve as building blocks /key raw materials for further processing into various other […]

TITAN- STOCK ANALYSIS

INVESTMENT RATIONALE Titan Company is on track to achieve the jewelry revenue guidance of 2.5x FY22 revenue by FY27, implying an impressive CAGR of 20%. Despite Titan’s current high trading multiple of 102, there is optimism based on the potential increase in market share from the current 7% to an anticipated 10% in the jewelry […]

VASCON ENGINEERS Stock Analysis

Established in 1986, Vascon Engineers Ltd is a Construction Engineering Company in India, with presence in real estate business having an asset-light model and Clean Room Partition manufacturing business. CMP = Rs. 74 Disclaimer: Invested The company operates in 3 segments: 1) Engineering, Procurement, and Construction(EPC)– Construction of Residential, Commercial, Industrial, and other projects. 65.4% […]