Most of the time, investors are risk-averse—they fear losses more than they desire gains. This natural caution keeps markets rational. Investors scrutinize assumptions, demand fair compensation for taking risks, and prioritize safety. When risk aversion is healthy, markets remain sane and reasonably priced.

But sentiments drive markets, and sentiments are rarely balanced. When optimism takes over, fear recedes, skepticism fades, and investors start overlooking risks. They become less demanding about returns, make aggressive assumptions, and lower their required premium for investing in equities.

Prices rise, optimism feeds on itself, and risk aversion disappears—leaving the market vulnerable.

A useful way to track this shift is through the implied equity risk premium (ERP). Despite its fancy name, ERP is simply the market’s built-in expectation for how much return equities should provide over risk-free assets. When risk aversion is high, ERP is elevated—meaning investors demand more compensation for uncertainty. But when optimism is excessive, ERP shrinks, signaling complacency and an overheated market.

Now, here’s the key: ERP is only useful when looking at it as forward-looking. If the risk premium looks too low, and you believe the compensation isn’t enough to justify the volatility and potential surprises ahead and/or you feel premiums might increase that’s when you become more cautious of equities, focus on selective bets, and avoid getting swept up in market euphoria.

| Current level of index 02-02-2025 | ₹23482 |

| Growth and Discount Rate Inputs | |

| Current long term Risk free rate* | 4.60% |

| Current ERP | 7.26% |

| Expected growth rate in the long term (after year 5) | 4.60% |

| Return on Equity Of Nifty 50 | 21.00% |

| Earnings Forecasts (Rs in Cr) | Last Year | |

| Earnings in LTM | ₹ 8,50,777.26 | ₹ 8,20,093 |

| Dividends and Buybacks in most recent year | ₹ 2,82,175.17 | |

| Earnings in 2025 | ₹ 9,02,102.30 | |

| Earnings in 2025 | ₹ 10,37,417.65 | |

- *RFR ⇒(10 Yr Bond Yield – Country Default Spread) = 6.770% – 2.18%

- Nifty Earnings CAGR 14% (Based on the self-sustainable growth rate, i.e roe*reinvestment rate)

- Cash Payout Ration assumed a gradual increase

| Implied Equity Risk Premium Calculator | |||||||

| Implied Risk Premium in current level of Index = | 4.89% | ||||||

| Last 12 months | 1 | 2 | 3 | 4 | 5 | Terminal Year | |

| Expected Earnings (Rs in Cr) | ₹ 8,50,777.26 | ₹ 9,02,102.30 | ₹ 10,37,417.65 | ₹ 11,93,030.29 | ₹ 13,71,984.84 | ₹ 15,77,782.56 | ₹ 16,50,360.56 |

| Expected cash payout (dividends + buybacks) as % of earnings | 33.17% | 33.17% | 38.78% | 44.40% | 50.01% | 55.63% | 78.1% |

| Expected Dividends + Buybacks(Rs in Cr) = | ₹ 2,82,175.17 | ₹ 2,99,198.02 | ₹ 4,02,339.73 | ₹ 5,29,692.00 | ₹ 6,86,197.30 | ₹ 8,77,736.13 | ₹ 12,88,853.01 |

| Expected Terminal Value = | ₹ 2,63,74,228.93 | ||||||

| Present Value = | ₹ 2,73,273.17 | ₹ 3,35,636.73 | ₹ 4,03,588.00 | ₹ 4,77,531.61 | ₹ 1,73,21,648.49 | ||

| Current Value of Index (Rs In Cr) | ₹ 1,88,11,678.00 | ||||||

By calculating the implied risk premium, we arrive at 4.89%, and with a 4.60% risk-free rate, the expected return on Nifty 50 stands at 9.5%—a rate that can now be matched by stable bonds in India. Given macroeconomic uncertainties, including GDP growth concerns, inflation persistence, weak consumption patterns, and geopolitical tensions affecting global trade, the premiums are likely to go up causing markets to remain range-bound or face potential corrections.

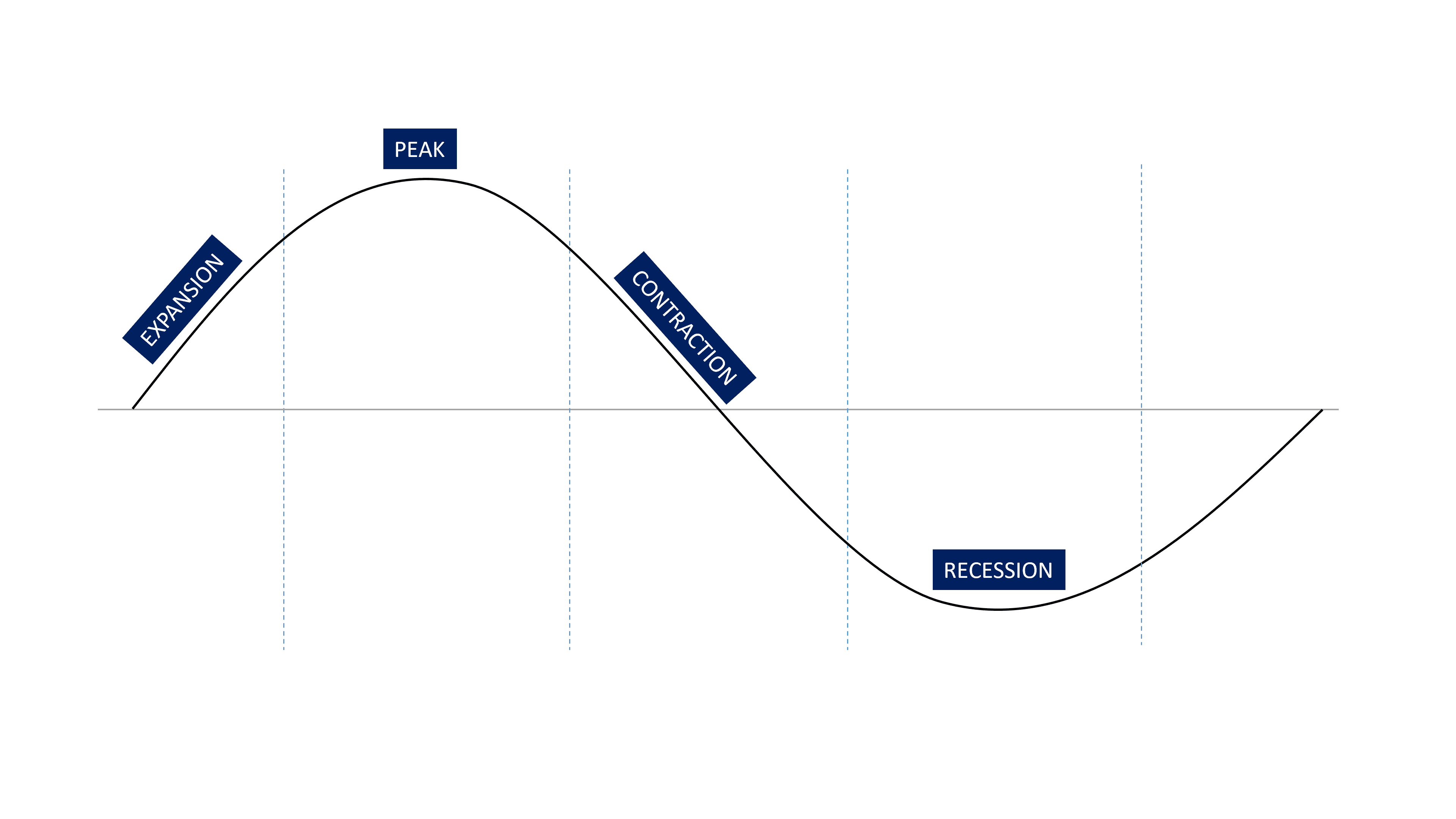

How Markets Cycles Unfold

On the Way Up:

- Economic fundamentals strengthen

- Earnings rise and beat expectations

- Media coverage turns overwhelmingly positive

- Investor expectations increase

- Psychology becomes increasingly bullish

- Risk aversion diminishes as capital flows freely

- Asset prices surge, fueling further optimism

- Those who missed the rally start buying in

At the Peak:

- Asset prices reach historically high valuations

- Prospective returns become minimal

- Risk levels peak

- Investors, driven by euphoria, ignore caution

- Fear of missing out (FOMO) dominates decision-making

Where Are We Now?

Current market conditions exhibit characteristics of a peak: ✔ Asset prices are high ✔ Optimism is widespread ✔ Risk-taking is aggressive ✔ Expected returns are low relative to risk-free alternatives

While this does not necessarily imply an imminent crash, it does warrant caution. Market tops can persist for extended periods, sometimes years, before a downturn materializes. However, excessive optimism leads to asset mispricing, as psychology and sentiment push valuations beyond fundamental justifications.

Final Thoughts

Asset prices are shaped by both fundamentals and psychology. A high level of optimism, all else being equal, inflates prices relative to intrinsic value.

At this stage of the cycle, the belts where money can be made are narrowing, and growth traps are abundant. Investors should be highly selective, avoiding overexposure to overheated assets and focusing on opportunities where fundamentals justify the price. Prudent investing is key in navigating this phase.