5 Investing Rules You Should Follow

to Achieve Investing Success

by Rajat Sharma | June 01, 2016

Investing Rule 1: It’s no different anytime

The guy who initiated the mutual fund landscape (Sir John Templeton) said:

The four most expensive words in the English language are, ‘this time it’s different‘.

Years have passed and landscape has changed tremendously. Back when Templeton first said the above, news did not flow as smoothly as it does today, there was no internet; and financial statements took a while to reach investors. Investors and money managers had to seek time to meet corporate management and share purchase was mainly done after elaborate paperwork. These days, we have algorithmic trading, 24 hour live finance news and internet to keep us updated with real time stock prices. Yet the economic cycle has remained intact. It plays out in the same order:

Technological advancement is sure an enabler but it can never change human nature. The economic cycle is a reinforcement of this fact. Today, if it seems that the world has taken much debt, that commodity prices are falling and demand is just not picking up, that crude oil is unlikely to ever revive – then the world may well be on course to recovery. If you can manage your investments around these cycles, you will make a lot of money.

Investing Rule 2: Separate knowledge from information

The collected body of work done by millions of analysts is constantly floating around over the internet. Such is the information overload that the same event is often reported both as positive and negative based on how the analyst perceives it. There is constant adulteration of information, news and opinions.

What is knowledge?

Much work has been done in data, information and knowledge management. I have the simplest definition when it comes to knowledge:

Knowledge: it’s the information you choose to store in your brain (and not on a computer).

What’s stored in your brain becomes the basis of your decision making. One of the finest skills to inculcate is the ability to reject information on first instance. Try this experiment – read a newspaper and make a list of headlines which you find worth storing in your brain for long. You will be surprised. The point is – when it comes to true knowledge, there isn’t much that you need to know. Less is more!

Investing Rule 3: Never stop learning

The process of learning:

1. Surround yourself with (people who have) a lot of information

2. Pay attention to what the knowledgeable says

3. Talk to a good listener

To be able to store knowledge, you need information. While the effort should be to block the unnecessary and ineffectual information from getting processed; if you don’t read, if you don’t pay attention to the source of information, you will be closing the avenue of knowledge.

Pay particular attention to those whom you find knowledgeable. But be careful . . . wrong selection in this area will naturally lead to devastating outcome, because here you will often be accepting as knowledge what would otherwise be just information.

You know the easiest way to process information and crystallize a thought?

Find a good listener and try to explain things to such person. Talking it out will crystallize your own thoughts. Good listeners can act as information processors for your brain.

Investing Rule 4: Learn how to deal with your emotions

There is a reason why behavioral finance remains a top choice for financial bloggers. The best of asset managers fall prey to their biases. Much effort has been made to explain common errors of judgement and how to overcome them.

Top 3 (common) behavioral biases in investing:

Anchoring – A situation where one starts relying a great deal on a single piece of information, often the very first piece of information which starts guiding his future decisions.

For example, an investor may be convinced that oil prices will remain low for the next 2-3 years because of the current oversupply in oil markets. For this reason he may not want to buy stocks of oil exploration companies. He will find himself ignoring all new information/ news which is contrary to his pre-set view. His mind is anchored towards not buying oil stocks.

How to deal with such a bias?

Evaluate everything on an individual basis. No one is infallible. Consider every new piece of information as a game changer.

Familiarity Bias – Some people get too focused on things they understand and make no effort to diversify their knowledge outside their area of expertise. I have met many investors who do not feel comfortable investing in stock markets. That’s fair. Yet another set feels comfortable investing only in real estate. Finally, there are gold investors – all their savings go into buying gold!

I once read a study that 80% of all drunken accidents in a neighborhood happened close to residential areas and not on nearby highways. On deeper examination it was found that it had nothing to do with how risky the neighborhood roads were. Drunken people typically slept when they got off the highway and reached close to their house. Reason – complacency; perhaps because they had reached a familiar environment.

How to deal with such a bias?

Of course you should be careful when you are doing something you think you understand very well; however, a better approach is to try something different every once in a while. You need to step out of your comfort zone to sharpen your mind.

Loss aversion – Nobody wants to sell something for a loss. Loosing Rs. 1000 will be more painful than earning a similar amount.

I regularly receive requests to re-balance client portfolios. What hurts investors in these kinds of reviews is not a suggestion to sell their profitable stocks but to sell the ones that are making a loss. Typical reply – Sir, why do you want me to sell XYZ @ Rs. 42. I purchased it @ Rs. 85. Its making a loss.

How to deal with such a bias?

Think about it – in the above example, if you could sell XYZ stock @ Rs. 42 and buy ABC stock which is likely to appreciate far more in future, then should you not do that?

Remember – your purchase price has nothing to do with the present scenario. To be brutally honest, when I do a portfolio analysis, I ask a junior to send me the list of stocks after removing the cost/ purchase price of the investor.

Also Read:

Psychological Traits of a Successful Stock Investor

Behavioral Finance: A Study of Biases Which Can Harm Your Investments

Investing Rule 5: Renew yourself

To maintain and increase effectiveness; renew yourself in body, heart, mind and soul. Make time for things other than your core activity. This is known to increase effectiveness both scientifically and medically.

I have come across people who can work 18 hours a day and need more of what they do to unwind and relax. If renewal comes to you by doing more of what you do, then there is something wrong somewhere. At the very least, find time to go for a run. Besides, nobody wants to be with someone who is constantly working. Don’t drive the world crazy!

Share this post

Don’t forget to leave a comment

Don’t forget to leave a comment

Other Posts

Other Posts

Top Power Stocks – Ideas for Long term Wealth Creation

As promised, here’s my post on power stocks and top ideas in this sector. I believe that at current prices these stocks offer great value and make a compelling buy case for anybody looking to build a long term wealth creation portfolio. Also see: A Video Post on these...

Update: Articles on the Main Site

If you are Subscribed to our website Feed using an external service, note that we now publish a lot more content on the website – https://www.sanasecurities.com/ I encourage you to subscribe to the feed of the main site as well. Some Recent Articles on Sana...

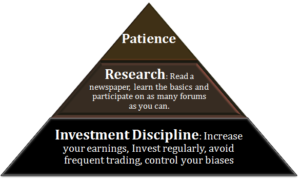

3 Habits for Successful Investing

Let me assure you – No matter how positive (or negative) you are about something, there will always be much which will not be in your control. There are things you cannot change and things that are totally in your control. The hard task is to understand the difference...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

0 Comments