5 Year Nifty Performance

by Rajat Sharma | May 04, 2016

The table below showcases 5 year Nifty performance.

Note: This is based on the current constituent companies of the Nifty.

Let me rearrange the above chart in descending order of returns. The results do tell a story:

Interesting Facts:

- 39 of the 50 Stocks have risen over the past 5 year period.

- During the same period the benchmark Nifty appreciated by 31.4%.

- Sectors that performed well – Private banking, IT, Automobiles and Pharmaceuticals.

- Under-performance – Oil & Gas (keep in mind that Cairn India was part of the Nifty until a few months back), Metals, Infrastructure and Power.

- The top 30 companies in the chart above have each grown at a CAGR of 10%+. Making stocks of each of these companies the best available investment avenues in hindsight (i.e. 5 years back).

- Based on previous track record of the Nifty: watch out for stocks in the infrastructure, oil & gas, metals and power space over the next 5 year period.

Here’s a table on the performance of Nifty stocks of April 2011. 14 companies marked in Grey got removed from the CNX Nifty basket over the past 5 years – i.e. between April 2011 to now. 12 of these 14 companies are in deep red, 1 got merged.

Visit here for sector wise weightage of the constituents of the Nifty 50

Share this post

Don’t forget to leave a comment

Don’t forget to leave a comment

4 Comments

Submit a Comment

Other Posts

Other Posts

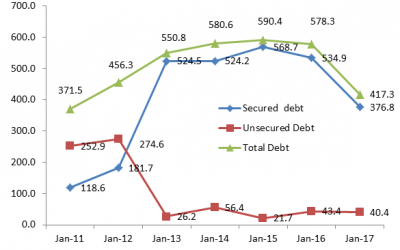

Everest Kanto Cylinder Stock Analysis

Price: Rs. 40.50 Disclosure: Invested The below analysis of Everest Kanto looks at concerns around falling revenues and EPS (including why the EPS is currently positive). Founded in 1978, Everest Kanto Cylinder Limited, together with its subsidiaries, develops,...

PTC India Limited Stock Analysis

Current Price: Rs. 121.90 View: Trade With Positive Bias PTC India Limited (“PTC” or “Company“) provides power trading solutions in India. The company is into: (1) Power Business: Long and short term power trading activities including cross border power trading...

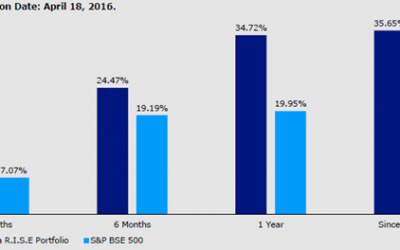

Invesco India RISE Portfolio – PMS Review

Here’s a look at the Invesco India RISE Portfolio. The basic portfolio strategy aims at investing in companies with: R: Recovery in Demand I: Idle Capacity with interest costs declining due to declining financial leverage S: Superior business models with healthy...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

sir r u adjust the bonus split dv/right etc in the price? in this article

Yes.

Nice & informative Article…Awesome Rajat

Thanks Pradeep