Portfolio Management Schemes (PMS) vs.

Mutual Funds – Better Investing Option?

by Rajat Sharma | May 19, 2016

Naturally, in most part, the answer to the question will be very case and client specific. For starters, not many will be able to invest in a PMS due to the rather large investment amount required to start.

Just like Mutual Funds (MFs), PMS provides professional management of client’s funds by investing in one or more class of assets. In this article, I will try to explain the advantages of investing in one over the other.

The key to understanding the pros and cons of Mutual Funds and PMS is to first recognize:

(I) Types of Mutual Funds and PMS;

(II) Portfolio Structure: Course of action that can be adopted in each case; and

(iii) Fee/ Commission Structures;

TYPES OF MUTUAL FUNDS AND PORTFOLIO MANAGEMENT SCHEMES (PMS)

Types of Mutual Funds

Each mutual fund will have a predetermined investment objective and investment strategy (growth or dividend). Mutual funds invest money across various asset classes like equity, debt and gold and / or a combination of more than one asset class.

To understand different types of mutual funds and their key features visit our mutual fund articles archive below:

Different types of Mutual funds

Best Equity Mutual Funds in India

Equity, Hybrid and Dynamic Mutual Funds

Who Should Buy Bonds/ Debt Mutual Funds

Mutual Funds Vs. Investing directly in stocks

How Many Mutual Funds Should You Own + Ideal Portfolio

Types of PMS – Discretionary and Non-Discretionary PMS

Assets under management (AUM) of discretionary PMS – increased 16% over the past one year, from Rs 67,299.07 Cr. in April 2015 to Rs 78355.84 Cr. in April 2016, according to data released by SEBI.

In discretionary PMS, portfolio manager takes investment decisions and has full discretionary power to manage investor’s portfolio, i.e. he can buy/sell stocks without consulting with the investor.

In non discretionary PMS, portfolio manager can suggest investment ideas; the rest is investor’s choice. In both the scenarios, portfolio managers can deduct fees/commission charges monthly, quarterly or yearly.

Also See: Example below in the point on ‘Fee Structure’.

PORTFOLIO STRUCTURE

| Mutual Funds | PMS Schemes |

| There is a limit on exposure to individual stocks (limited to 10% in a single stock) in a mutual fund. | There is no limit in terms of stock or any other instrument specific exposure. Portfolio manager can make more aggressive allocations. |

| Typically cannot take positions in derivates (F&O) markets other than for the purpose of hedging positions. | Can buy/sell in derivates (F&O) markets to make trading gains. |

| Mutual funds typically have wide diversification. For example, a typical equity mutual fund will invest in 40-50 stocks from many sectors. The focus usually is capital preservation with reasonable return. | Will have 10-30 stocks/ strategies or other financial instruments at a given time. The underlying idea is to generate high returns usually with some or more capital risk. |

| Minimum investment amount can be as low as Rs. 500. | Minimum investment has to be Rs. 25,00,000/- and above. |

| Investor only fills an application form to invest in a mutual fund scheme. The scheme in turn acts same for all investors. | Each PMS investor and the portfolio manager enter into a separate agreement which could have different terms in each case. |

In addition, each PMS account is managed individually, i.e. the portfolio manager can buy/sell different stocks in different client accounts. While legally this is allowed, for ease of management and execution, a portfolio manager would execute same orders in all accounts or at best have 3 different fund groups such as – Value, aggressive and low risk.

FEE/ COMMISSION STRUCTURES

A PMS investor has a choice to decide how he would like to pay his portfolio manager. Unlike mutual funds where expense ratio for each fund is pre-decided for every investor, in a PMS scheme the investor can choose from different commission slabs which portfolio managers offer. In addition, it is possible to have a completely different fee arrangement. In short, it’s a matter between the investor and the portfolio manager.

Example

Investor A invests in a discretionary PMS an amount of Rs. 25,00,000 and agrees to pay a fund management fees as below:

Fixed management fee of 2% per annum (charged quarterly @ 0.5% on average NAV) plus a 10% share of profit per annum.

After 3 months, the amount grows to Rs. 30, 00,000. The portfolio of the client will automatically deduct Rs. 14,000 as management fees on the last day of the quarter (calculated assuming that the average NAV for the quarter was Rs. 28,00,000).

At the end of the year, the amount grew to Rs. 34,00,000. In addition to the quarterly management fee, the portfolio of the client will also deduct Rs. 90,000 (i.e. 10% of the yearly profit of Rs. 9, 00,000 on the starting value of Rs. 25,00,000).

While the fees may seem like a lot, it is only because the portfolio generated over 36% return in the year. If the portfolio did not generate any profit then the portfolio manager would only make his management fees.

Further, the fee structures could vary and as a client you will have the right to choose a structure you are more comfortable with.

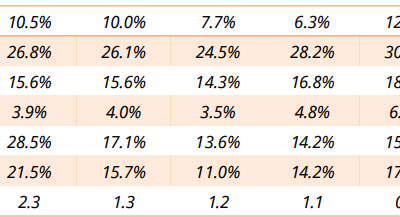

Examples of some fee structures being offered by the same PMS:

If an investor in non discretionary PMS invests Rs. 25 lacs and after 3 months, the amount grew to Rs. 28 lacs, then also the portfolio manager will charge on the profit generated based on the terms on which such a client availed the service.

This is how the scheme information document will disclose the nature of scheme:

The Portfolio Manager offers only Discretionary Portfolio Management currently. The Portfolio manager will exercise any degree of discretion as to the investment or management of portfolio of securities or funds of the client.

View

FOR BENEFITS OF INVESTING IN PMS SCHEMES CALL – +91 8368931743.

In general, It is Impossible to save on the management fee (of~ 2.5%) by purchasing disclosed portfolio stocks on your own. Typically, by the time the fund makes a disclosure of the stocks they are holding, these stocks have already run up by well over 5-10%. Naturally, the fund manager wants you buy it on your own to take the prices higher after he purchases.

If you are a High Net Worth Individual with some appetite for risk and can spend long time in the market, you should opt for a good PMS; particularly if you are looking to take equity exposure. For Long Term Savers and professionals, who wish to invest smaller amounts in a systematic manner, mutual funds offer a viable solution.

Finally, if you are a Seasoned Investor who understands the markets and more importantly, can keep an investing discipline, the best option will be to open an account and invest yourself. If you belong to the last category, I encourage you to use my services as much as you can :-).

Happy Investing!

For any questions, write in to me at rajat@sanasecurities.com or call me on 9833905054

Share this post

Don’t forget to leave a comment

Don’t forget to leave a comment

9 Comments

Submit a Comment

Other Posts

Other Posts

Shree Karni Fabcom- Stock Analysis

Earlier this year in March 2024, Shree Karni Fabcom made a stellar debut listing at Rs 260 apiece, a premium of 14%. Its IPO offer price was Rs 228. At present, the stock trades at Rs 750 per share. Financial Metrics Shree Karni Fabcom Market Cap ₹ 534 Cr. Current...

L T Foods Stock Analysis

Valuations L T Foods L T Foods is available at cheap valuations. Company is growing revenue (19% CAGR over last 3 years) and profits (29% CAGR over last 3 years) at good rate, however, it is still valued at a PE of 16, which signifies good scope of re-rating. In our...

Long-Short Ratio

The index futures long-short ratio serves as a crucial sentiment indicator, reflecting market sentiment by comparing the number of bullish positions held by foreign institutional investors (FIIs) to their bearish positions. A low ratio suggests that FIIs are bearish...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

which is the best pms fee option a,b or c?

Do returns vary scheme to scheme? C Just charges 3 % but B charges 2+20% profit?

You have to select a pms whose interest (fee structure) is perfectly aligned with yours. I have invwsted in Sana Securities PMS, Excellent work guys.

All Stock brokers say “Investment in Securities in subjected to market risk” It is correct if the market is booming and if the companies you have invested is also gaining then your account will also reflect the same Similarly Vice versa. Investing in PMS is a good approach to build you Wealth, Before investing in nay companies it is essential to do in depth market research , If you dont have much experience or knowledge in this field then better to opt for Discretionary portfolio management services that is your shares will be managed by an experienced Portfolio manager.Check whether there is lock in period etc. Whether its a SEBI registered Stock broker. A studied investor who chose the right stocks should get much better returns than a blind investment. Most cases you will get profits. I am an NRI having a PMS account with Capstocks, one among the best online stock brokers with more than 27 years of excellence. I started with 25L on March 2014 and my Net Asset Value on May 2017 was 34,31,000 L , Appreciation on May 2017 is 45L, So you see i have gained a quiet and i think most of the cases you can gain some if invested with some Top PMS performers. I can assist you if you need any help about my experience. Feel free to ask.

I have been investing in MFs so far.I am now a retired person.

I had some FDs which are maturing now.I thought I should invest in PMS.Have consulted some AXIS bank advisers who tell me to opt for ASK .While some other of my friends advise me to opt for Motilal Oswal group.

I can keep my investment for a minimum duration of 3 years.May be for 5 years too.For my livelihood I have some rental income from property .

Pl advise me the better option.Also ttell me if the decision to invest in PMS instead of

MFs is he right decision

Dear Rajat,

I am an NRI and looking for guidance and advice on my investments in India. I have been investing in direct equities and MF, however feel that my investment choices have not been optimal. I have a corpus of INR 1 Cr+ invested in India and abroad (3-4 shares), which I would like to consolidate and streamline it for better returns.

I have looking for PMS options in India and wonder whether you would advise a good PMS provider with reasonable fee. Couple of names I came across where – Motilal Oswal, Equity Intelligence and Kotak Mahindra AMc. My time horizon is 5 year+ and I can stay invested for longer terms if the returns are good and promising.

Dear Rajat,

I’m NRI, invested 30lac in Karvy debt PMS scheme, where I’m getting approx. 11.4% quarterly return. I wants to further investment 25-30lac. Please suggest needs to invest in PMS or mutual fun. If PMS, then which one is better for quarterly return. If mutual fund then suggest 5-6 mutual fund, where i can invest 5 lacs to each one.

Regds,

Pawan

Hi,

I am NRI customer and would like to invest in PMS. I am considering either Ask IM PMS (IEP PMS scheme) and my second options is Ask IM Growth PMS.

Can you please let me know your view on Ask IM PMS if we compare to Motilal Oswal NTDOP?

Thanks,

Punit AB

With market at all time high is it worth entering PMS with fresh money of 25L

I am regular Mutual fund investor and have corpus around 25lac. And have another ~30lac more to invest. Need your advise on my fresh investment whether I should go for PMS or MF fund. My investment horizon is 3-5 years and have moderate risk appetite.

Please suggest some good PMS and incase of MF then suggest few MF where I can invest.

Thanks in advance.