Recent Recommendations and Market Outlook

by Rajat Sharma | April 29, 2016

[1] Rama Steel – Manufactures Galvanized Iron (GI Pipes) which are typically used in water, sewage, and oil and gas transmission and are also put to various uses in the infrastructure sectors. The Company operates through 3 manufacturing facilities:

2 plants at Sahibabad (Uttar Pradesh) with capacity of 75,000 MT per annum and 24,000 MT per annum. 1 plant at Khopoli (Maharashtra) with capacity of 36,000 MT per annum. For the Khopoli plant the Company is planning to ramp up its capacity to 2,40,000 MT taking its overall installed capacity to 3,40,000 MT per annum. The Company has acquired 20 acres of land on site. For FY 2015, the company reported a sales turnover of Rs. 200 Cr. with exports accounting for 40% of its gross sales. Additionally, as per disclosure made to BSE, the Company plans to set up a plant with a capacity to manufacture 60,000 MT steel tubes in South India.

[2] Va Tech Wabag – is a leading player in the water treatment space and provides turnkey solution in below categories:

- Drinking water treatment

- Industrial waste water treatment

- Municipal waste water treatment

- Industrial and process water treatment

- Desalination (sea water and brackish water)

- Recycling (industrial and municipal waste water)

Va Tech Wabag is a debt free company, with a very strong growth track record. What I like most about this stock is the growth in its order book. In previous years the order book was growing at ~ 15% CAGR. For this year we expect the order book to grow at ~60%. This should play out in the coming quarters.

Click here for a detailed report on the stock.

[3] Axis Bank – I am always bullish on blue chip private sector banks. Unlike public sectors banks, private sector banks have structural growth stories and are less impacted by asset quality challenges. Within the private sector, we are positive on those banks which get a lot of their revenue from service sides (i.e. non-funded revenue), like Axis or Kotak. Axis gets about 20% of its revenue from non-banking fee based services.

I am disappointed with the Axis performance this quarter, its net profit down by 1% and Net NPAs stood at 0.70 % (GNPA at 1.67%) for this quarters.

Given the well capitalized balance sheet, robust return ratios (Average 5 year growth in RoE stands at 17.01%), Axis Bank is a definite long term buy. I believe, going forward Axis will outperform its private sector peers. The 3 banking stocks for a long term portfolio remain – Kotak, HDFC and Axis.

Click here for a detailed financial report on the stock.

[4] HDFC Bank – Pick up the fact sheet of any mutual fund house, HDFC Bank will find a place their. This ensures that going forward a lot of the fund money (via new mutual fund investments and SIPs) will keep flowing in this bank, unless something drastic happens which looks unlike as of today.

Here is a report that I authored on HDFC stock almost 2 and a half years back. In terms of trends, everything stated in that report has remained the same or has only improved.

[5] ONGC – a price earrings of 11, it is still a steel. I have recommended this stock at 189, then at 206 and now at 216. I plan to do this again in future, may be at a higher price. If you believe these markets would go up and that crude prices will bounce back, then its one of those buy and hold forever kind of stocks. Currently you are getting it at a dividend yield of 4.4%. So you’ll be making 4.4% tax free return a year which is at par with any fixed deposit. The company has reserves of 1 lac 80 thousand crores and debt of 48 thousand crores. Your dividends are safe. Plus fundamentally there have been some very interesting developments for the sector:

Click here for a detailed report on the stock.

- Pricing freedom for discoveries in difficult terrain – the hike in gas prices here is up to 60% from current prices.

- The Company is raising up to 1 billion USD funds for acquisition of an oil field in Russia

They have got 2 of their oil blocks back from Essar recently, the management is yet to ascertain the exact addition here.

Share this post

Don’t forget to leave a comment

Don’t forget to leave a comment

3 Comments

Submit a Comment

Other Posts

Other Posts

Debt Mutual Funds – Yes bonds are cheap, but for a reason

Over the last few years debt mutual funds have gained popularity over fixed deposits, purportedly for tax efficiency and better returns. The real reason for their popularity however lies in the fact that these funds were promoted far more aggresively than other fixed...

Nifty 50 Q3 (FY 2019) Results

Nifty 50 Q3 2019 results

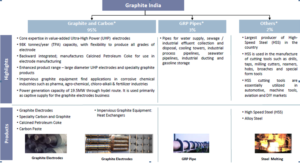

Graphite India Stock Price: One off or have things turned around?

Graphite India Limited (“Graphite India” or the “Company”) is the largest Indian producer of graphite electrodes* and one of the largest globally, by total capacity. Graphite India manufactures full range of graphite electrodes with focus on higher margin, large...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

If we look at the market statistics for April 2016, ICICI BANK and SBI stocks fared rather well and were highly recommended by several online as well as offline market portals.

Would you also recommend these if one is looking for a long term portfolio?

If we look at the market statistics for April 2016, ICICI BANK and SBI stocks fared rather well and were highly recommended by several online as well as offline market portals.

Informative