What’s the Golden Rule for Self

Investing Success?

by Rajat Sharma | June 06, 2016

If you visit my blog regularly then by now you would have come across many posts on self investing and how you are the best person to take care of your finance.

In past, I have written about common mistakes people make with investing. I have also written about stock selection criteria, personality traits and the psyche of a successful stock investor.

Today I will reveal that one trait without which no investor has ever become successful (though money may have been made in speculation or by a sheer stroke of luck).

Before I get to that, let me share with you a performance track record on the very first offering I started– “Stock of the Month”.

Rule: I recommend one stock each month. Every month I ask subscribers to Invest a fixed sum in this stock hoping to beat the performance of most indices and fund houses.

In the last 39 months, there were only 2 occasions where I recommended selling a stock that I had recommended in a prior month. The performance below is adjusted to reflect the loss booked on sale of theoe stocks.

- I had meant for this portfolio to work as an SIP. This is multi-cap stock portfolio with an emphasis on capital preservation.

- In the 39 months since we started this portfolio, we have accumulated 34 stocks (5 stocks were recommended twice in different months).

- Annualized return of our stock of the month portfolio over the last 3 years = 23.02%.

Annualized return of BSE Sensex over the same period = 9%

So what’s the Golden Rule?

DISCIPLINE

No amount of reiteration of this principle is ever enough.

It is not hard to make money in the market. What is hard to avoid is the alluring temptation to throw your money away on short, get-rich-quick speculative binges. It is an obvious lesson, but one frequently ignored. – Burton Malkiel; A Random Walk Down Wall Street.

How can you maintain Discipline with Investing?

What works well for the mutual fund industry in not so much the ability of the fund manager but the discipline which mutual fund investments can help you inculcate. 50% of successful investing in about controlling your emotions and staying disciplined.

If you are planning to start a regime of self investing and expect to make ~ 18% Y-O-Y return, follow just 2 rules and you will tremendously improve your long term performance:

The best strategy in these markets still remains:

“Earn more to Invest more”— Rajat Sharma (@SanaSecurities) May 26, 2016

- Set aside a sum: the best way to invest is to set a discipline in terms of how much money you can put aside each month. Lets say Rs. 10,000/-. Make sure whatever amount you set aside is such that you do not need it back for a very long time. On the first day of each month, buy 1-2 stocks with this money. I typically recommend a stock on the 15th day of each month for the above ‘stock of the month basket’.

- 10/20 % Rule: At no point should your portfolio be invested more than 10% in a single stock. If you feel strongly about a stock, buy it again; but even then 20% is the maximum you should buy in a single stock. Feel free to create another short or long term portfolio do not to disturb the sanctity of your long term portfolio.

Naturally, the approach above will require lots of discipline and is suitable for those who earn a regular monthly income/ salary (i.e. regular stream of monthly cash flow is a given). If you are a trader who wants to multiply an existing base of capital by buying/ selling stocks frequently, you may not find this approach very . In the latter case, the amount of potential return may go up but so will the risk.

Share this post

Don’t forget to leave a comment

Don’t forget to leave a comment

5 Comments

Submit a Comment

Other Posts

Other Posts

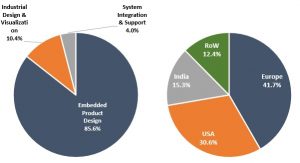

Tata Elxsi Stock Analysis

TATA ELXSI STOCK PRICE: Rs. 778 Tata Elxsi Limited (“Tata Elxsi” or the “Company”) is amongst the world’s leading providers of design and technology services across industries including Automotive, Broadcast, Communications and Healthcare. Tata Elxsi is helping...

Which Debt Mutual Fund Should You Buy?

Over the last few weeks, I have been reading many articles on various aspects of debt fund investing. I have also received many queries on where investors should park their money to cushion against stock market uncertainty. To quote some of the more relevant...

NEITHER A BULL NOR A BEAR – A CREDIT CRISIS VIEW

Over the past few weeks, I have made some major changes to client portfolios. The ongoing credit crisis perhaps has changed my general tone on stocks, and other financial assets. I am not trying to rein in on anyone, nor suggest that a Multicap approach is astute...

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Free Investment Newsletter

Join us and connect with over 65,000 subscribers who benefit from our insights on the latest

in the world of stocks and personal finance.

Indeed! Discipline and consistency is what counts. I have been investing since 6 months now, many of my friends and relative sell their stock in a max period of a month by booking either small profit or loss; and i have seen stocks rising after that; though it is just 6 months but i am seeing the results, i plan to hold them as long as fundamentals do not deteriorate

Best Post. Well written. I love the way you are writing and the way you conduct research. Keep it up Sir.

Thanks Ashutosh

nice details in website,good knowledge

Worthy information on investing stock,i learned know.